Business Insider: A Gas Station Ad Platform Says Its Business Is Soaring in the Pandemic As Driving Picks Up. Here’s the Pitch Deck It’s Using to Win Advertisers.

By: Patrick Coffee | Business Insider

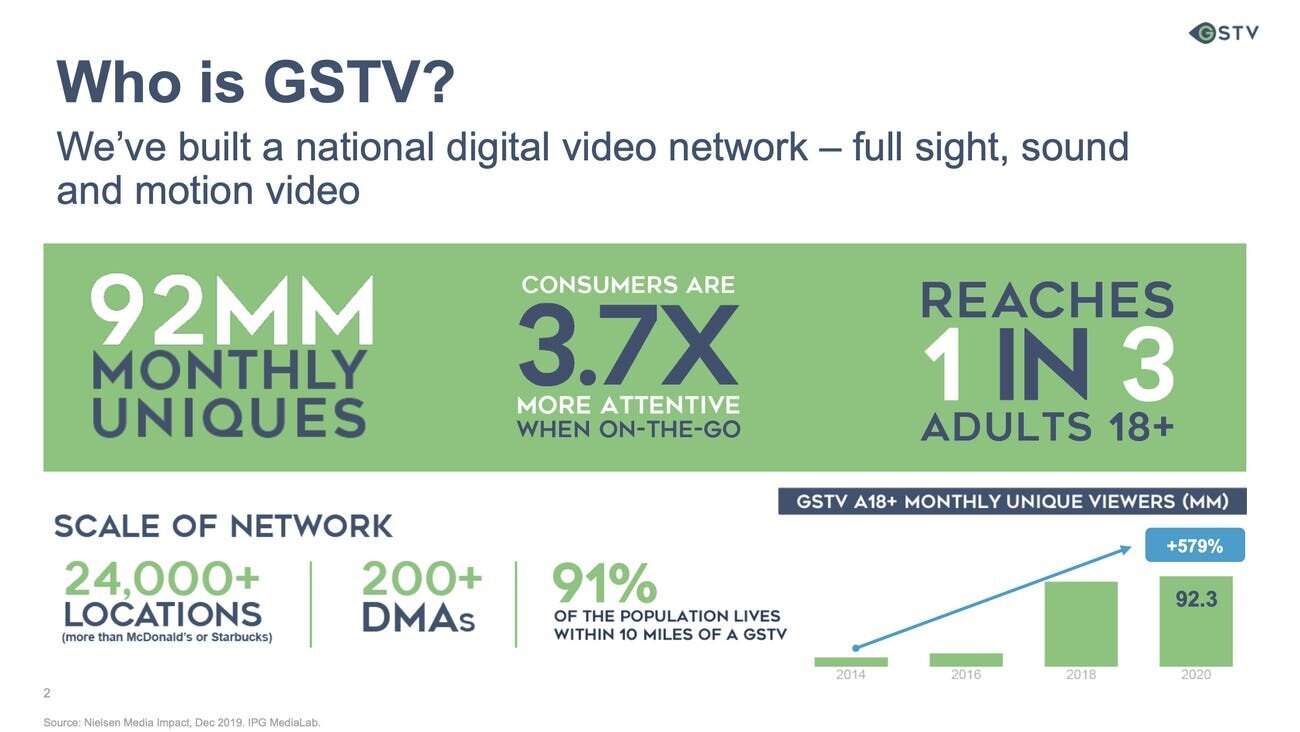

GSTV, which runs ad-driven videos at gas stations, has grown in recent months despite the pandemic's dramatic impact on the ad industry, according to CEO Sean McCaffrey.

Its pitch deck to advertisers makes the case that they can reach people in transit at a time when they're likely to spend money.

GSTV hopes to be an alternative way for brands to boost sales now that foot traffic is down and the status of big advertising events like live sports remains unclear.

Visit Business Insider's homepage for more stories.

The pandemic has people relying on their cars more than ever before — and advertisers want to reach them as they drive.

That is the central insight behind a pitch deck that GSTV used to return to growth by emphasizing the continued role that gas stations play in American life, according to CEO Sean McCaffrey.

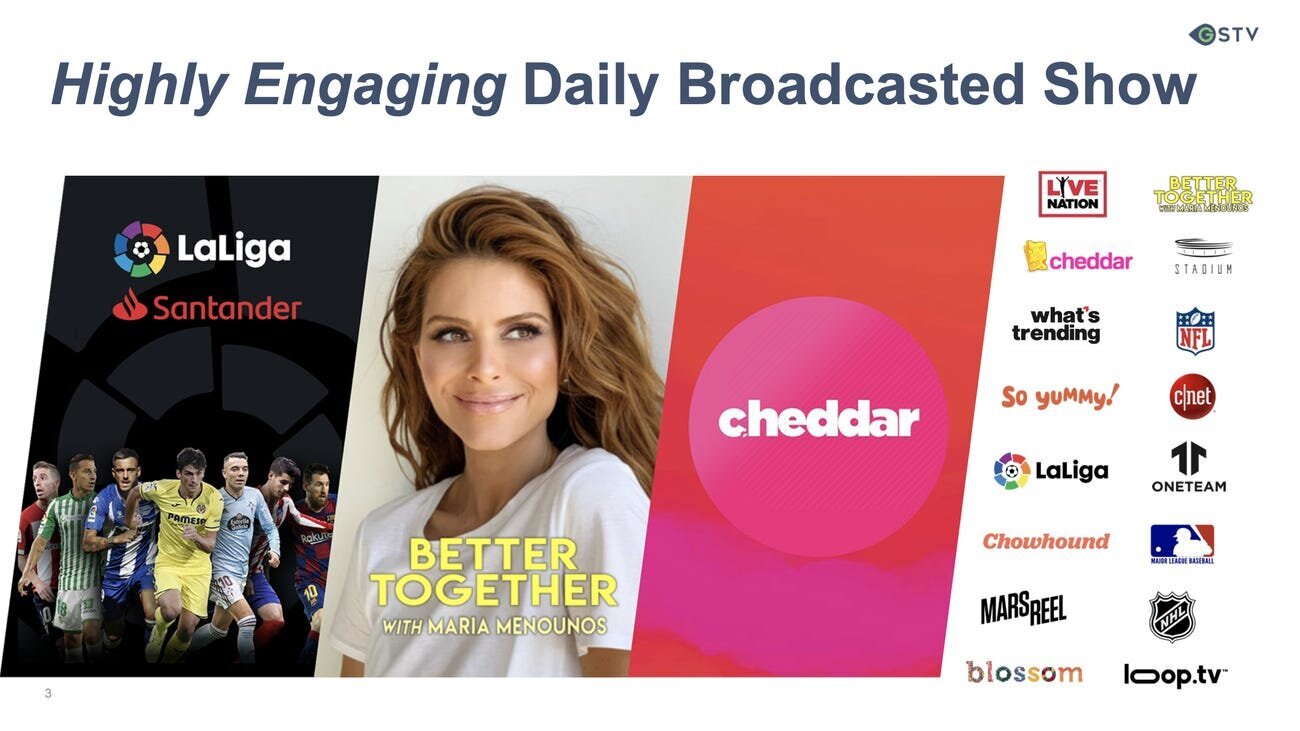

GSTV is a private, nationwide network that provides an ad-driven video service to stations and convenience stores like Circle K and Speedway. Each day, GSTV releases an original clip of news, sports, entertainment, and ads that plays in front of drivers as they refuel.

McCaffrey said the platform, with 24,000 locations, reaches one in three American adults who are traveling by car.

GSTV is classified as out of home advertising, which accounted for $8.6 billion in spending last year. McCaffrey wouldn't share GSTV's revenue but said its clients include PepsiCo and that some brands have spent up to eight figures on the platform annually.

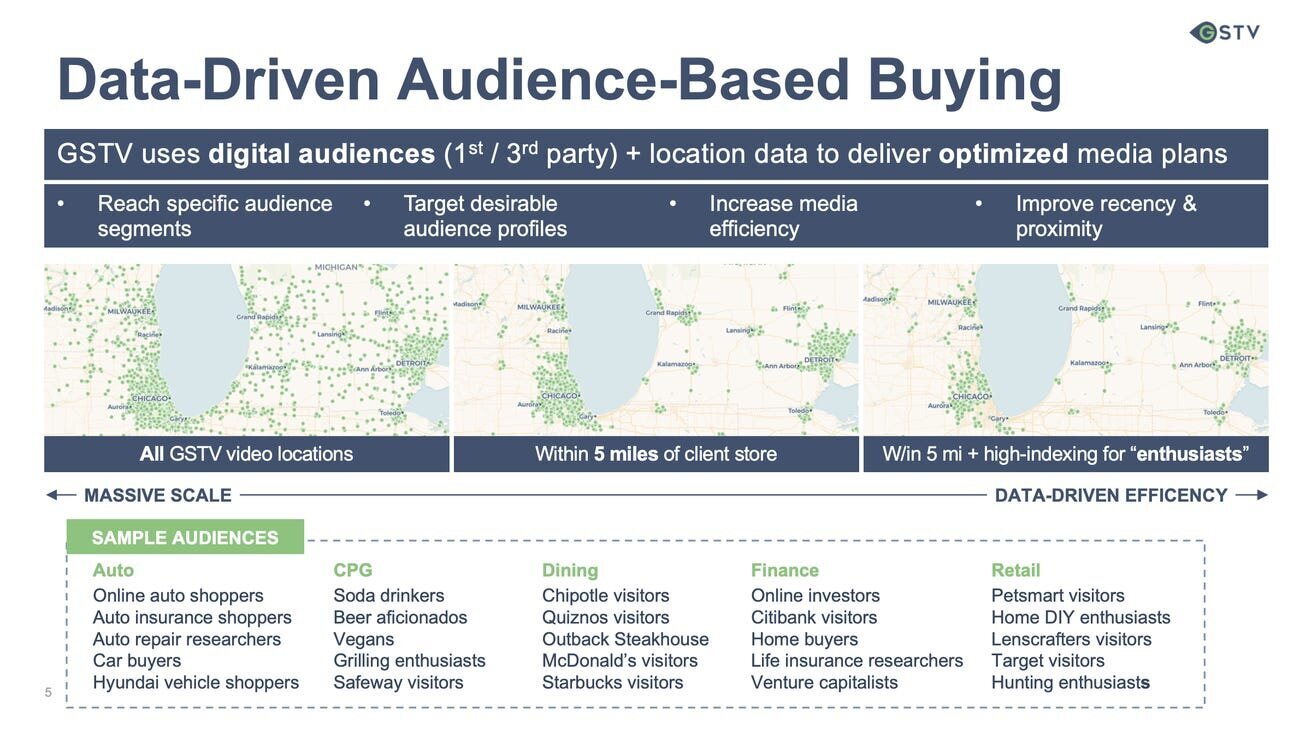

He said a key element of its appeal is that people spend far more money on the days they refuel, particularly at grocery stores, big box retailers, and fast food chains. And most also use their credit cards to buy gas and other items at the stations, creating anonymized first-party data that GSTV can use to target ads.

McCaffrey said the company then helps advertisers run hyper-local campaigns that promote nearby businesses or target the sort of people most likely to use a certain gas station based on both demographics and buying behaviors.

"We think of each station as an addressable household," he said.

GSTV hopes to fill a void left by the cancellation of live sports and other top ad spaces

McCaffrey said his company has weathered the effects of the pandemic and exceeded pre-coronavirus growth in recent weeks via the strategy outlined in the pitch deck GSTV has presented to media-buying agencies and brands.

"We've had more brand-direct conversations in the past six months than in the last two years," McCaffrey said. "Brands are generally taking more ownership of outreach because the market is so chaotic."

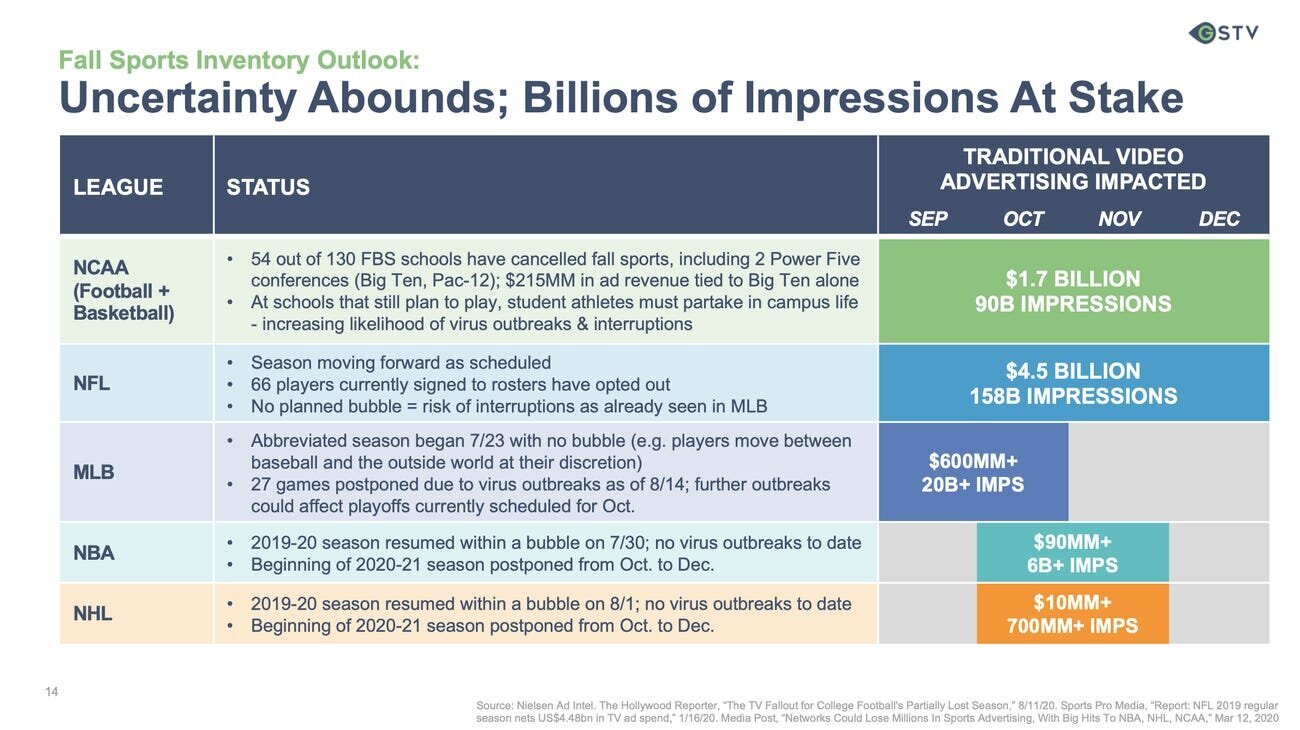

The deck also emphasizes the money left up in the air by the cancellation of major pro and college sports leagues to appeal to marketers who are under pressure to prove that their spend drives sales.

Another reason GSTV was less affected by the pandemic than some ad businesses, McCaffrey said, is that its audience included essential workers who were on the front lines in the earliest days of the quarantine.

The platform has also collaborated with the Centers for Disease Control and Prevention and the Ad Council in recent months, airing public health campaigns and PSAs encouraging consumers to frequent restaurants and other businesses.

The deck claims GSTV has more locations than McDonald's or Starbucks.

Partners include the NFL, Live Nation, host Maria Menounos, and news network Cheddar.

Data from Mastercard says customers spend almost four times as much at big box stores after filling their tanks than they do on days they don't fill their tanks.

The deck says Chipotle can use GSTV data to target people who live near a restaurant or whose demographics make them likely customers.

GSTV worked with IPG's Acxiom to target those most likely to own a particular brand of car.

Affordable gas has encouraged greater mobility amid lockdowns, according to the deck.

GSTV argues advertisers can reach Americans driving over the holidays as driving replaces air travel.

Its data shows consumers on the move spend more at each stop than they did pre-pandemic.

Spending at convenience stores is up more than 100% compared to the same period in 2019, the company says.

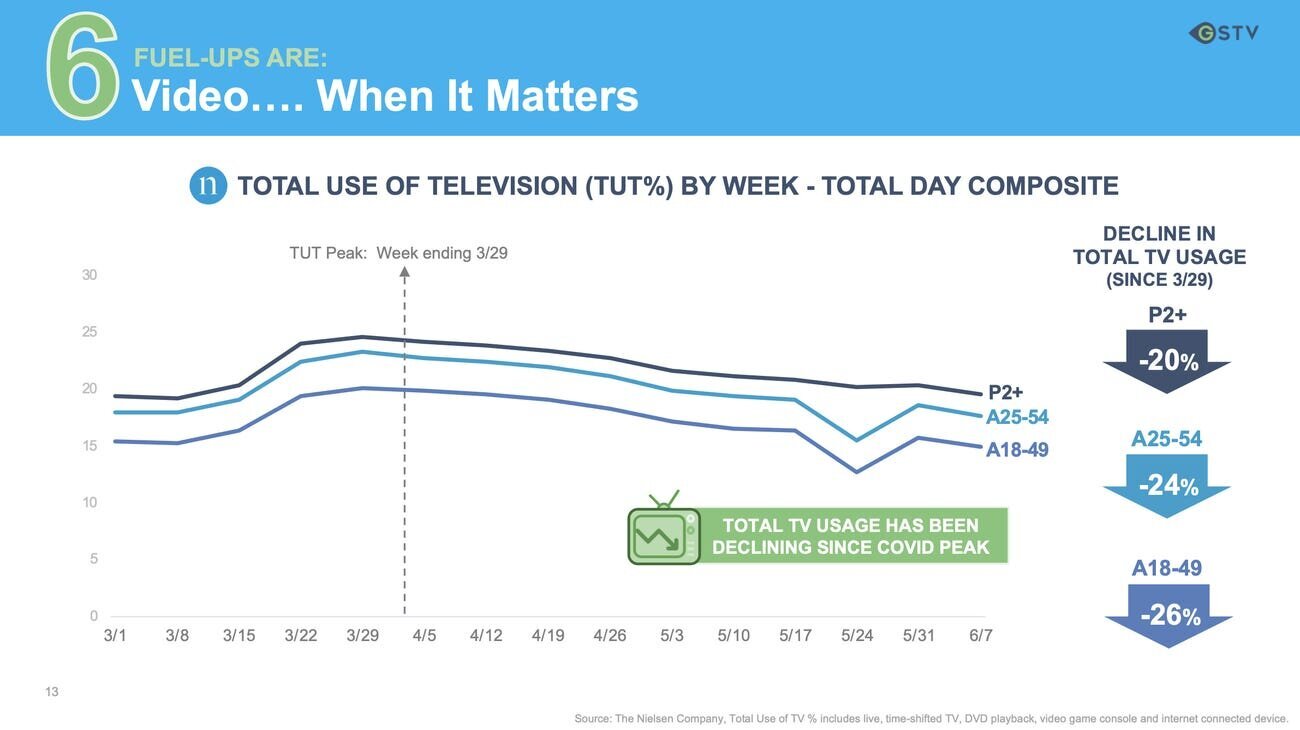

TV viewing is also down by more than 20% among key demographics since the pandemic's peak in March.

GSTV claims it can help replace the billions lost in live sports ad deals.

Gas stations were among the businesses least affected by the pandemic, according to data from Foursquare.

Adweek: What McDonald’s Acquisition of Dynamic Yield Means for DOOH and Personalization

Brands are able to target their consumers are every touchpoint feasible

By Sean McCaffrey | Adweek

Last month, McDonald’s announced its largest acquisition in 20 years. Yet the $300 million purchase of Dynamic Yield was notable for another reason: It legitimizes outdoor as a two-way medium for ad messages and delivers personalization at scale.

Simply put, McDonald’s, long a leader in outdoor advertising, has signaled that the space will be used for creating a dialogue between consumers and brands. The purchase lets McDonald’s vary its electronic display of items and DOOH network for walk-up or drive-thru customers based on the weather or consumer demand. For any franchisee who has ever mused that a product or service would be a perfect day for certain promotions then this purchase gives hope that they might be able to switch to promoting ice cold drinks when the temperature rises or hot chocolate on inclement days. But more importantly, it also connects that in-the-moment message to all other data-driven consumer engagements in both paid media and in-store messaging.

Too often we miss the true value of innovation in the moment and only grasp more foundational shifts in hindsight. It’s those brands and agencies that execute on such tectonic shifts that can accelerate their growth and gain share even in mature markets. With this acquisition, we’re seeing that singularity, the moment that will most matter in years to come, right now with DOOH and its impact on marketing strategy and investment outcomes.

The evolution of DOOH is clearly more than signs becoming screens. The marketer’s goal of presenting the right message to the right person at the right time is now in reach. DOOH networks have broadcast-level scale and bring added benefits of location-based context, dynamic creative and sequential messaging on the literal consumer journey. Such an objective has long been elusive for the $8 billion U.S. out-of-home market but now appears to be imminent. As with previous advertising innovations, marketers who embrace the technology first will reap the rewards.

It’s time to consider the truly available digital audience nature of the classic OOH channel.

Such promise is one reason why digital out-of-home spending has continued to outpace all other buying methods and is a bright spot in the menu of advertising options. This is bigger than dynamic screens; it’s the birth of digitally-enabled communication between brands and shoppers. It’s time to consider the truly available digital audience nature of the classic OOH channel.

But let’s face it: OOH has traditionally suffered from the one-way nature of its communications. A billboard can’t hear or recognize you, so the consumer has a natural advantage over it. Or, alternatively, it’s been judged only by physical placement. But what if OOH is now considered more broadly as every consumer touchpoint outside the home including in-restaurant placements? The location and physical context still matters that’s OOH’s most core value.

Current state-of-the-art technology can already vary messaging based on the time of day or the weather, but now, connected audience data drives true convergence of mobile, location-based and addressable audience marketing inclusive of DOOH.

Such sentient displays inject consumer intelligence into even routine interactions so a store rep can suggest a new or offbeat menu item that a shopper might like because it’s based on knowledge of their buying patterns. Suggesting the right offer, news, entertainment or insight to a targeted group of consumers in real-time drives results.

Imagine how such technology would work if adapted to pretty much every consumer. It would know better than to promote a new drink to someone who never varies from his standard purchase but could reap incremental sales from someone who’s open to such a suggestion. That’s the promise of cognizant out-of-home: It’s an intelligent system that knows both the store’s selection and the frame of mind of the visitors at moments in time.

Of course, such types of listening can be abused, but ideally it augments a human staffer who merely sizes up a consumer based on their age, sex and other signs of purchase intent to make a well-thought-out recommendation.

The best marketers have always understood the power of OOH. It offers massive canvases, broadcast scale, location-based targeting, unavoidable messaging and truly special creative opportunity. The past several years of Cannes Lions OOH winners have shown the new promise of the medium such as Google, Twitter and others. But many have also ignored the medium due to perceived limitations like targeting, measurement, attribution and true integration with overall media and creative strategy in the digital age.

The potential magic in this acquisition is the realization that all consumer touchpoints are an opportunity to personalize at scale.

Such is the evolution of DOOH, which can bridge the gap between out-of-home brand communication and a consumer’s personal profile. In the process, OOH is meeting consumers in the digital audience age.