Business Insider: A Gas Station Ad Platform Says Its Business Is Soaring in the Pandemic As Driving Picks Up. Here’s the Pitch Deck It’s Using to Win Advertisers.

By: Patrick Coffee | Business Insider

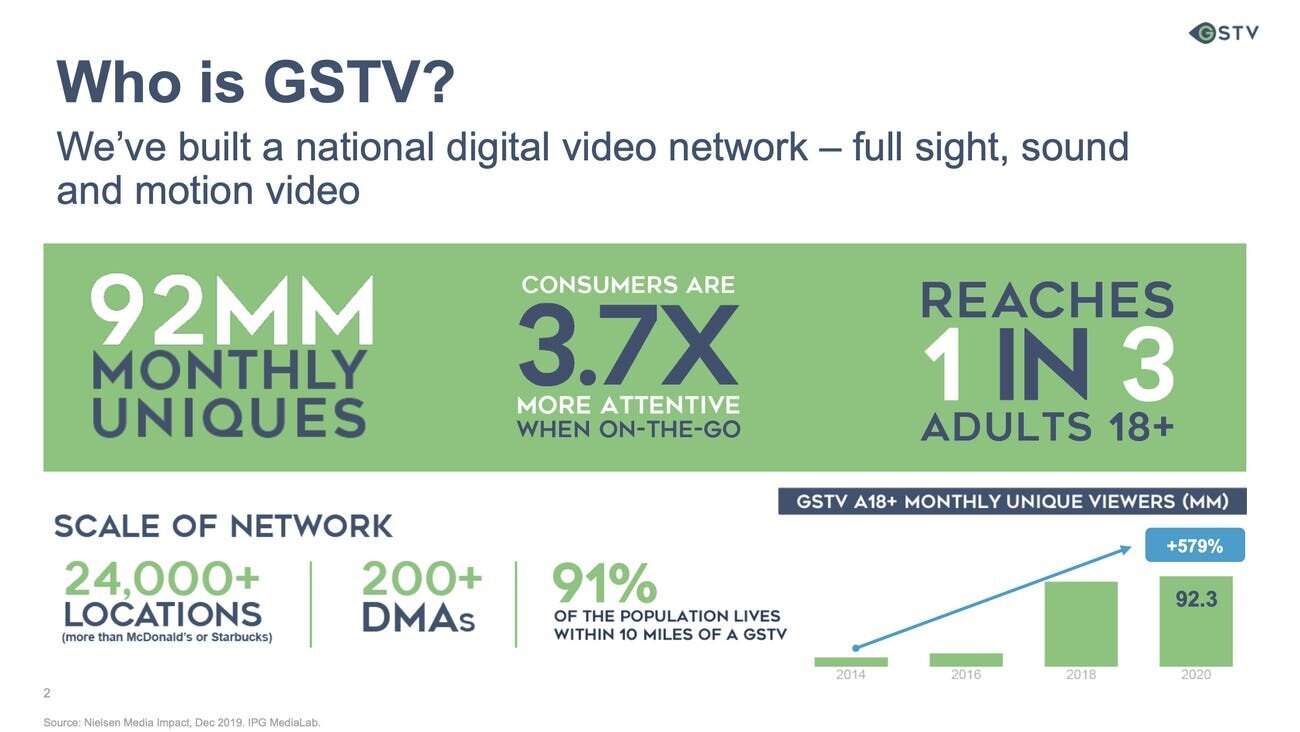

GSTV, which runs ad-driven videos at gas stations, has grown in recent months despite the pandemic's dramatic impact on the ad industry, according to CEO Sean McCaffrey.

Its pitch deck to advertisers makes the case that they can reach people in transit at a time when they're likely to spend money.

GSTV hopes to be an alternative way for brands to boost sales now that foot traffic is down and the status of big advertising events like live sports remains unclear.

Visit Business Insider's homepage for more stories.

The pandemic has people relying on their cars more than ever before — and advertisers want to reach them as they drive.

That is the central insight behind a pitch deck that GSTV used to return to growth by emphasizing the continued role that gas stations play in American life, according to CEO Sean McCaffrey.

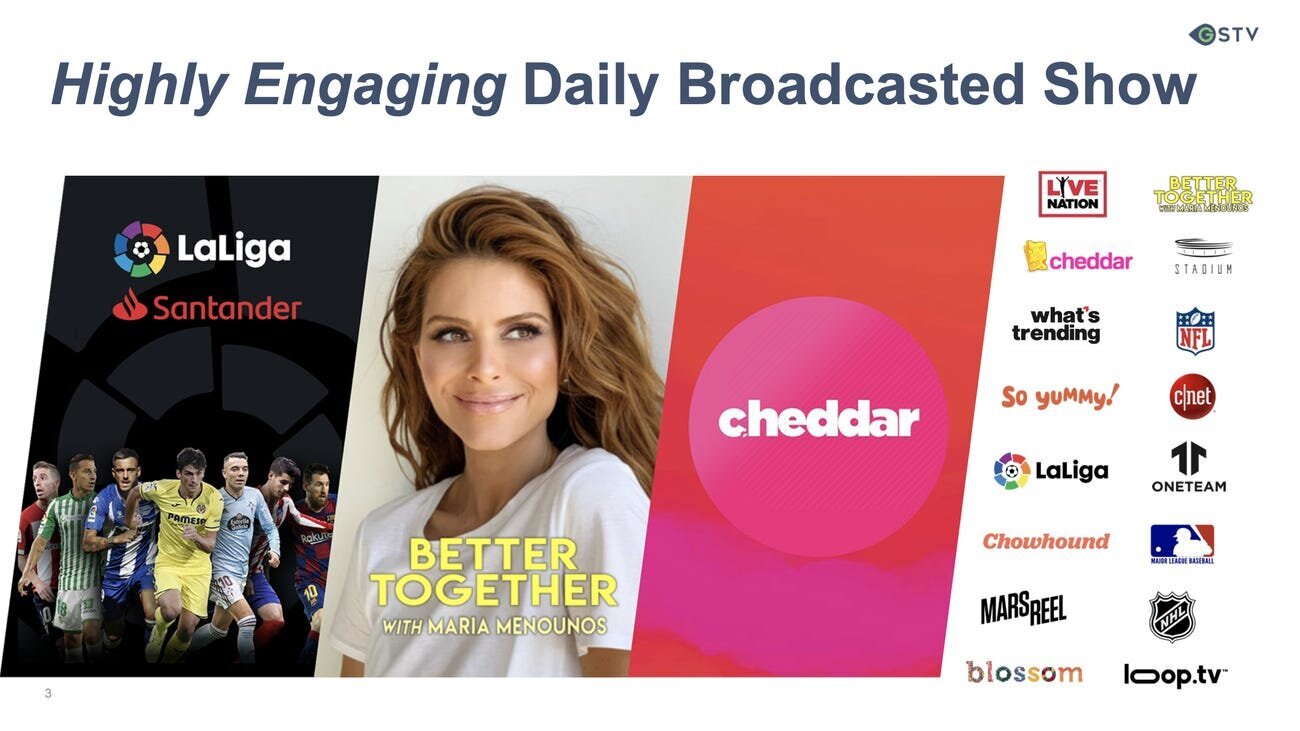

GSTV is a private, nationwide network that provides an ad-driven video service to stations and convenience stores like Circle K and Speedway. Each day, GSTV releases an original clip of news, sports, entertainment, and ads that plays in front of drivers as they refuel.

McCaffrey said the platform, with 24,000 locations, reaches one in three American adults who are traveling by car.

GSTV is classified as out of home advertising, which accounted for $8.6 billion in spending last year. McCaffrey wouldn't share GSTV's revenue but said its clients include PepsiCo and that some brands have spent up to eight figures on the platform annually.

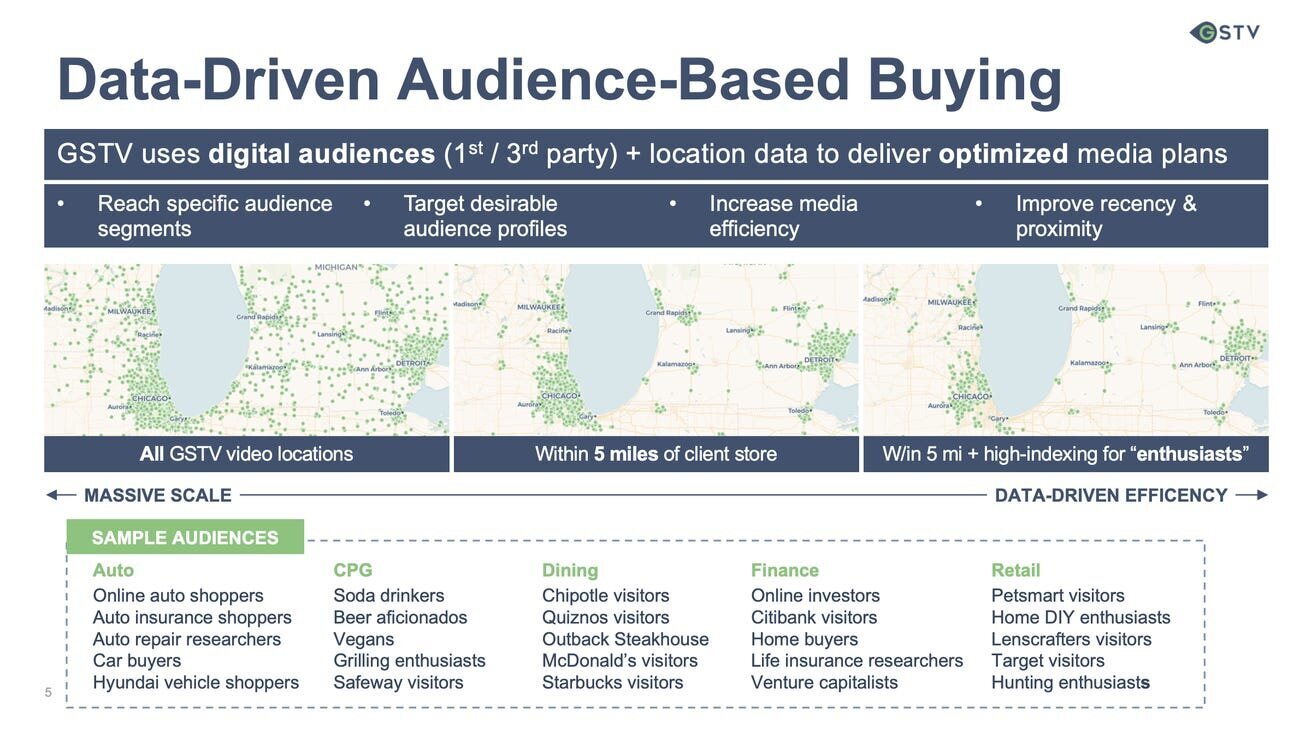

He said a key element of its appeal is that people spend far more money on the days they refuel, particularly at grocery stores, big box retailers, and fast food chains. And most also use their credit cards to buy gas and other items at the stations, creating anonymized first-party data that GSTV can use to target ads.

McCaffrey said the company then helps advertisers run hyper-local campaigns that promote nearby businesses or target the sort of people most likely to use a certain gas station based on both demographics and buying behaviors.

"We think of each station as an addressable household," he said.

GSTV hopes to fill a void left by the cancellation of live sports and other top ad spaces

McCaffrey said his company has weathered the effects of the pandemic and exceeded pre-coronavirus growth in recent weeks via the strategy outlined in the pitch deck GSTV has presented to media-buying agencies and brands.

"We've had more brand-direct conversations in the past six months than in the last two years," McCaffrey said. "Brands are generally taking more ownership of outreach because the market is so chaotic."

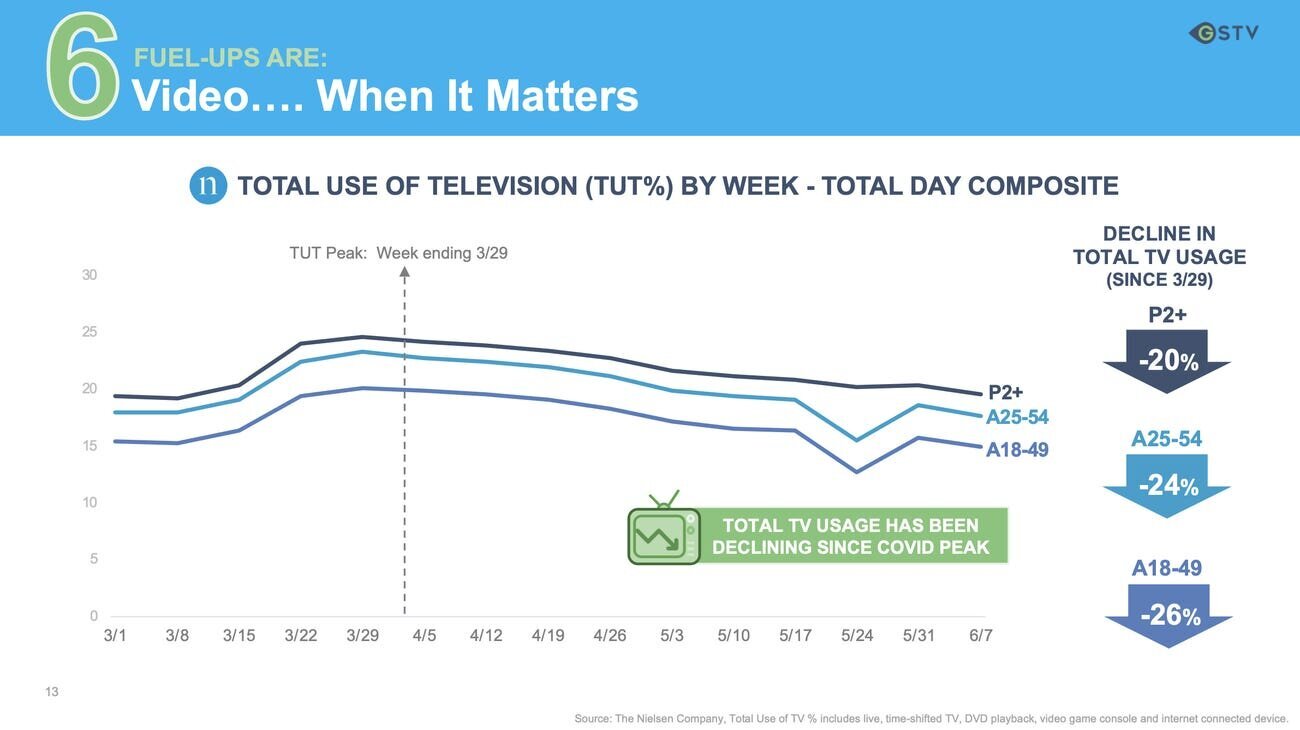

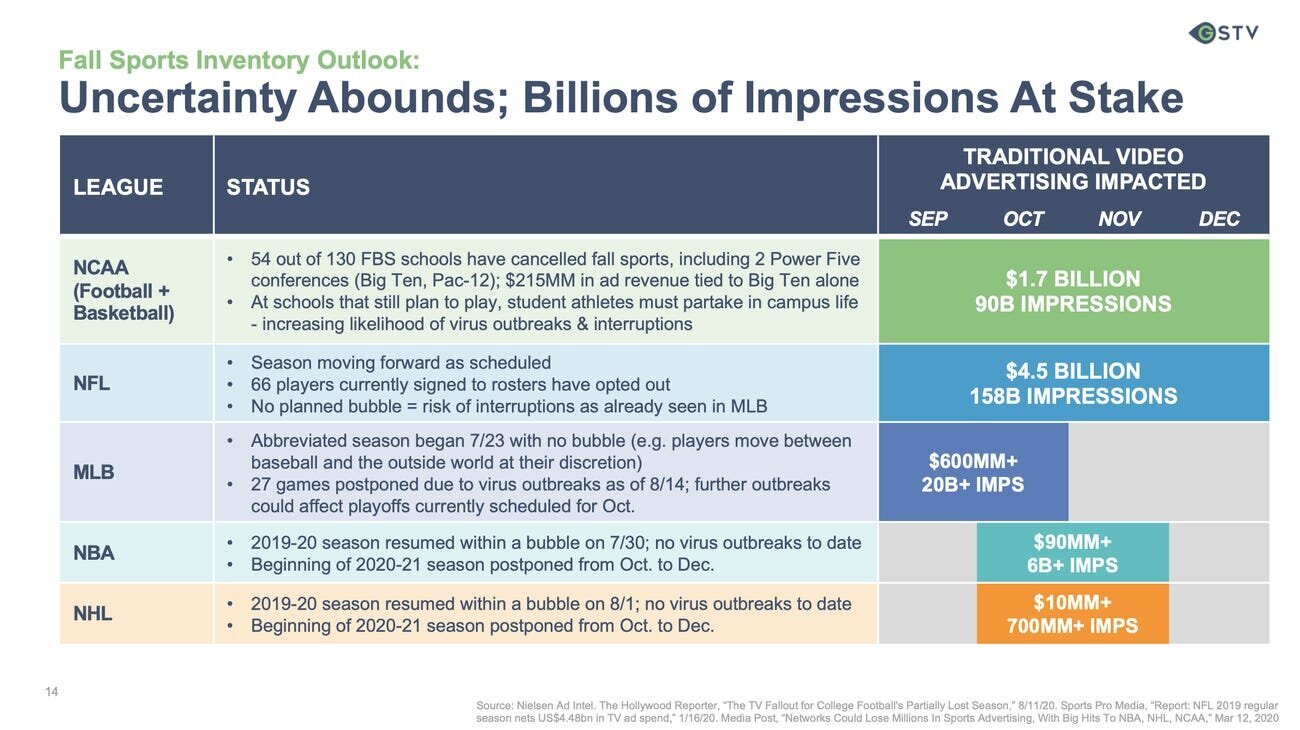

The deck also emphasizes the money left up in the air by the cancellation of major pro and college sports leagues to appeal to marketers who are under pressure to prove that their spend drives sales.

Another reason GSTV was less affected by the pandemic than some ad businesses, McCaffrey said, is that its audience included essential workers who were on the front lines in the earliest days of the quarantine.

The platform has also collaborated with the Centers for Disease Control and Prevention and the Ad Council in recent months, airing public health campaigns and PSAs encouraging consumers to frequent restaurants and other businesses.

The deck claims GSTV has more locations than McDonald's or Starbucks.

Partners include the NFL, Live Nation, host Maria Menounos, and news network Cheddar.

Data from Mastercard says customers spend almost four times as much at big box stores after filling their tanks than they do on days they don't fill their tanks.

The deck says Chipotle can use GSTV data to target people who live near a restaurant or whose demographics make them likely customers.

GSTV worked with IPG's Acxiom to target those most likely to own a particular brand of car.

Affordable gas has encouraged greater mobility amid lockdowns, according to the deck.

GSTV argues advertisers can reach Americans driving over the holidays as driving replaces air travel.

Its data shows consumers on the move spend more at each stop than they did pre-pandemic.

Spending at convenience stores is up more than 100% compared to the same period in 2019, the company says.

TV viewing is also down by more than 20% among key demographics since the pandemic's peak in March.

GSTV claims it can help replace the billions lost in live sports ad deals.

Gas stations were among the businesses least affected by the pandemic, according to data from Foursquare.

Business Insider: 'We're different': Cheddar founder Jon Steinberg says ignoring conventional wisdom led him to a $200 million cash exit to cable company Altice USA

By Business Insider

Jon Steinberg broke a lot of the rules of digital media when he launched Cheddar in 2016 as a live video service for millennials who were drifting away from traditional TV. While others said you needed to own your audience, focus on brand-safe content, and have a subscription revenue stream, the former BuzzFeed president built a news brand on other people's platforms and based on advertising.

That approach has won over investors and advertisers, if not media pundits.

Cheddar raised $54 million in two years and was on track to do $27 million-plus in revenue last year and move toward profitability this year. And cable system Altice USA just bought it for $200 million in cash. That's a healthy multiple considering the recent industry rule of thumb that said venture-funded digital media companies would sell for 2.5 to 5 times their past year's revenue.

"It's a great result for the digital video world," said Peter Csathy, founder and chairman of media consulting firm Creatv Media. "It underscores the importance of live streaming. Live streaming is now front and center for media companies and the brands that support them. The level of engagement is deeper than on-demand streaming. This is the audience the brands and advertisers want to reach. And it's news for millennials, by millennials. At a certain point, Wolf Blitzer doesn't speak to a young audience."

Steinberg said Cheddar worked because he didn't follow the conventional wisdom guiding other venture-backed media companies at the time. Instead, he bet that streaming services aiming to replace traditional TV would take off, and that these burgeoning companies would need low-cost content for those millennial viewers.

"We're different," Steinberg told Business Insider. "When I started this company, people said skinny bundles weren't going to work; now there's Pluto, Philo ... We're in 40 million pay-TV homes, at a time when everyone said everything's going to be a subscription. We have a small but roaring advertising business."

Other digital media startups saw their businesses tank when Facebook ended live video funding and distribution for media companies. The rise in streaming and other distribution services helped Cheddar recover from the loss of Facebook video funding.

"When Facebook turned off the oxygen on Live, I said, 'Who are our friends, who are our partners,'" Steinberg said. "Pluto said, 'can you do election night,' Hulu was, 'can you do news.' So rather than crying about it, we moved on. We're surrounded by friends. There's so many pay-TV systems who need lower-cost content for young people, and we need distribution."

For Altice's part, it has been expanding its news operation, which consists of its 30-year-old local News 12 channel and i24News, a 2-year-old global news network. It made a small investment in Cheddar back in 2017 and started running Cheddar content on its channels. Steinberg will become president of the company's Altice News unit.

"We've been focused on news; it's a category we believe in," said Charlie Stewart, Altice's CFO. "We bought Cablevision three years ago to reinvent the industry to be fast, entrepreneurial. The way Jon operates is consistent with how we approach it."

Steinberg's ubiquity model extended to some unconventional places like airports and gas stations. Others may sniff, but Steinberg said it's been a great way to get exposure for Cheddar.

"I love the gas station TV," he said. "I want to do more of the gas station TV. It's all marketing for the brand. We don't pay them, they don't pay us. I can't tell you how many people tell you, 'I love that on the gas station.' Then they see it on Roku and they say, 'That's the guy from the gas station TV.'"

Digiday: Digital-first publishers have fallen in love with Gas Station TV

The screens at gas station pumps are looking more and more like Facebook feeds.

Gas Station TV has been building a content slate of publishers that are popular on digital platforms, steering away from its past relationships with big TV networks like CNN and ESPN.

This week, GSTV partnered with First Media’s Blossom and So Yummy. Earlier this year, GSTV added Cheddar and Chive TV. They join What’s Trending, CNET, Stadium, MLB and The List. The partnerships are part of GSTV’s strategy to show content that can entertain consumers at the pump and in tandem inspire more advertising dollars, instead of just relying on repurposed content from cable networks. Meanwhile, the digital publishers say GSTV has effective distribution, and the Detroit-based team is a lot more enjoyable to work with than others.

“I can’t believe how big it is. Every single day someone sends me a photo of Cheddar on it. I wish I could buy GSTV. Plus working with GSTV is a lot more fun and easier than Facebook,” Cheddar CEO Jon Steinberg emailed.

“GSTV has been an amazing partner. I literally get posts on social and even people in person saying they’ve seen me on GSTV. It has an incredible presence and reach as well as retention. You can’t go anywhere when you’re at the gas pump so we have a captive audience,” said Shira Lazar, CEO of What’s Trending.

These digital publishers aren’t making exclusive content for GSTV — at least not yet. For now, they’re providing 20-second clips every week or biweekly, in some cases. The GSTV content team then uses it to program more than 18,000 locations. Publishers say the gas pumps are a complement to mobile distribution.

“In general, when consumers see you everywhere, you have a bigger opportunity to have them then follow you on social. You look around and everyone’s heads down on the mobile feed, but there are a few places in the real world where you can grab their attention,” said First Media’s chief revenue officer Charles Gabriel.

A survey of 282 media buyers by Digiday this November found that the top three formats most media buyers expect to increase spending in are video formats.

Leo Resig, CEO and co-founder of Chive Media Group, echoed the scale they see with gas stations. Chive TV joined GSTV in November. The deal aligns with a strategy to appear in more places out of homes. Recently, Chive created a spin-off company called Atmosphere to manage their distribution in restaurants, bars, cruise ships, airports and more.

“As with any digital media publisher, the past couple of years has had its fair share of headwinds of publishers trying to scale their audience whether it’s their owned operations or distributing on social. You can’t discount that GSTV reaches one in three people over 18 in the U.S.,” Resig said.

At the moment, money isn’t changing hands in these deals. It’s a “value trade,” Resig said. GSTV gets free content from publishers, which they can insert ads between, and publishers receive free distribution. But Gabriel of First Media said they are in talks for revenue sharing, and his company’s sales team is prepping how to include branded content in the slate for early next year.

“Most of the locations have a retail shop and within a few miles of a major retailer like Walmart, which we do work with. All of our content is set up to show consumers how to use products, create, be clever,” Gabriel said.

Connecting ads and publishers with customer data is a key focus of GSTV CEO Sean McCaffrey. He joined GSTV in September 2017 after spending more than 16 years at Clear Channel Outdoor. In April 2017, GSTV and Verifone announced a 50-50 joint venture.

McCaffrey and his new hires have been ramping up data collection and analytics at GSTV through partnerships with Acxiom, Placed, Dstillery, IRi, Nielsen and LiveRamp. Since inception, the pitch of screens at the gas pump may have included the fact that its consumers aren’t simply getting off their couch, fueling up and going home. But now, GSTV has more data to prove it.

GSTV sells ads at stations in a similar way to an addressable household, McCaffrey said. Advertisers receive behavioral data and audience data, all anonymized and in aggregate. GSTV claims to have more than 75 million monthly unique viewers and can target ads to specific markets, charging on a CPM basis.

Publishers, even though they aren’t getting paid by GSTV yet, praised McCaffrey’s leadership for focusing on new content providers.

“Ads on a screen are ads on a screen and dwell time is dwell time, but how can you get people to pay attention? How do you get ads in front of people without turning the world into one giant NASCAR with ads everywhere? People are realizing that you need a content-first approach,” Resig said.

Cheddar: GSTV CEO Says Network Reaches More People Than Spotify

GSTV, which delivers content across thousands of fuel retailers in the U.S., reaches 75 million unique visitors and hopes to reach one in two adults in the next few years. Sean McCaffrey, president and CEO of GSTV, said that the scale of the company is increasing daily.

MediaPost: Cheddar's Next Platform Is The Gas Station Pump

Cheddar, the “post-cable” news network, is making the jump to the gas pump. The company will now provide content to GSTV, which programs content to screens at more than 18,000 gas station pumps across the country.

Under the terms of the deal, Cheddar will provide new segments to GSTV. The segments will be about 20 seconds long and focus on topics like technology and entrepreneurship. They will rotate in and out a couple of times per day to keep them fresh.

“We have always had a bit of a news, sports, weather, editorial angle, and with great respect to some legacy publisher brands, they aren’t built for today’s consumers or today’s models,” Sean McCaffrey, president and CEO of GSTV, tells Digital News Daily, explaining why the company wanted to work with Cheddar.

“It’s a nice story of everything old being new again,” Cheddar CEO Jon Steinberg says. “This is a platform that used to have traditional content, and now they are working with someone like us that has new content.

"We are sort of an internet-first brand that traditionally you would only associate with digital platforms. Yet, we are able to work with a great firm with a tremendous footprint. It is an incomprehensible number, of quantity, of public space.”

Cheddar has grown its audience in part by trying to make itself as ubiquitous as possible. Cheddar and its general-interest news network Cheddar Big News are available on most streaming video bundles, such as Sling TV and YouTube TV, and even a number of traditional cable packages.

The company has also embarked in a strategy to make itself available outside of traditional video bundles and social networks. It acquired MTV Networks On Campus and rebranded it as CheddarU earlier this summer, bringing Cheddar’s content to some 600 university campuses.

“We are trying to mimic what traditional cable networks like CNN or CNBC have done,” Steinberg says. “CNBC, it has magazine shops at airports. I don’t even know what the CNBC shops are. CNN has the Airport Network. We are trying to follow that model, our content is ideal to be watched in the background, as well.

“We preserve the authentication value in that the only way [consumers] get the full feed is through the authentication package, like Sling or Hulu or YouTube TV.”

The deal actually started with an offhand comment by a journalist, asking why Cheddar wasn’t on the gas station TVs yet. McCaffrey replied to Steinberg on Twitter, offering to speed that process along.

“It was a classic example of right place, right time,” McCaffrey says, adding the millennial audience of Cheddar aligned nicely with GSTV’s target audience.

“More millennials stop at a GSTV station in a given month than Starbucks. It is a captive few minutes where we want to entertain somebody,” he says, noting people often refuel their cars while out shopping, and spend 1.7X more than they typically do following a fuel transaction.