We’re pumped! Filling up gas tanks, finding missing kids

By Patricia Davis, NCMEC

As you hit the road this holiday season, be sure to check out the video playing on your gas pump when you stop to top off your tank. You could help bring a missing child home for Thanksgiving.

At more than 26,000 gas stations in 48 states, GSTV is giving motorists – 96 million a month – some light-hearted entertainment, news, sports, music, even DIY tips on videos playing at the pump during the few minutes it takes to fill up their tanks. It’s also giving them a chance to potentially save a child at risk.

In 2019, GSTV began partnering with NCMEC and sharing photos and information about missing children at participating gas stations in 25 states. Since then, 148 of the 223 missing children it has featured have been safely recovered.

Each month, we give GSTV information about one to three children for each location who are either missing from the vicinity where motorists have pulled over for gas or are believed to still be in the area or in the state.

Many are endangered runaways – at risk of being trafficked for sex or exploited in other ways – or children who have been abducted by non-custodial family members or, in rare cases, by strangers. Some are children who have recently gone missing; others have been missing for as long as 20 or 30 years.

The company distributes 15 to 20-second videos with the child’s photo, descriptive information and our hotline number, 1-800-THE-LOST (1-800-843-5678), for motorists to call if they’ve seen the child.

“If you’re on the move you need gas,” said Senior Producer Rebecca Steinbach, who oversees the program at NCMEC. “I’d encourage everyone to pay attention to what’s on the screen. It’s a short video, but please look at it. It just takes one person to find a missing child.”

Since we opened our doors more than 37 years ago, one thing has remained constant: photos of missing children are the most effective tool for finding kids. What has dramatically changed is how fast we can distribute those photos and how we can pinpoint with precision the people in the best position to help.

Through our photo partners, we’ve distributed literally billions of missing posters and helped law enforcement recover more than 355,000 kids. From the long-ago days when photos of missing kids were placed on milk cartons, we can now quickly geo-target them to a very specific area – campgrounds, shopping malls, even a stretch of highway – where law enforcement believes a missing child might be found.

The partnership with GSTV grew out of the successful music video campaign, “Runaway Train,” that featured images of missing children. We did a remix of Soul Asylum’s ground-breaking music video from the 1990s, collaborating with artists Jamie N Commons, Skylar Grey and Gallant, which was played on social media and television.

We wanted to keep the campaign going, with the goal being to get as many eyes as we could on the missing children in the video. What better place than gas stations which are in every town and where you literally have a captive audience at the pump? (except in New Jersey and Oregon where you can’t pump your own gas.)

“Our goal is to continue to help NCMEC recover missing children,” said Violet Ivezaj, SVP, Business Operations, with GSTV, which donates the video time and production to us. “We’re leveraging our platform and those 96 million monthly viewers to do good and help NCMEC bring those children home.”

The value of being able to enlist gas stations to help us find missing kids is immeasurable, said Steinbach. Everyone at one time or another stops at a gas station to fill up, get a quick bite to eat, ask for directions or use the restroom – even missing children and the people who abduct them.

In one case, Steinbach said law enforcement was especially concerned about a missing Pennsylvania girl who they believed to be in extreme danger and asked that she be featured on GSTV. A friend saw her photo, knew she was frightened and hiding, and called police.

In addition to leveraging their videos on the gas pumps, GSTV is trying to do more to help by recruiting those gas stations with convenience stores to become safe havens for missing children, said Dan Trotzer, EVP, Industry, for GSTV.

“We also want staff to be aware when a child is missing,” said Trotzer, noting that gas stations are frequent places where a missing child might end up and are often open 24-hours a day. “They can come in the convenience store and be protected.”

GSTV has been encouraging gas stations to get their employees plugged in and involved. Through NCMEC’s Adam Program, businesses like convenience stores and the public can sign up to receive emails or text messages when a missing child is believed to be in their area in real time. Gas station employees are learning what steps to take if they encounter a missing child. And it’s working.

One 15-year-old girl was being held captive for three months and her parents were frantic. More than 300 miles from home, she devised a plan to escape, repeatedly asking her abductor to stop at a gas station so she could use the bathroom. When he finally did, she bolted from the car and ran inside the convenience store for help. Realizing she was in danger, the employee locked her in the bathroom to keep her safe and called police.

Another convenience store in Texas that recently signed up for the Adam Program posted a missing poster of a 1-year-old baby, the subject of an AMBER Alert, in their store that a customer happened to see. When the customer returned to her apartment complex, she spotted the abductor with the child outside the complex and anonymously called police.

Missing children have even seen their own faces on the videos at gas pumps, including a 15-year-old South Dakota boy missing for three months and believed to be in Colorado or Wyoming. He was featured on GSTV, where he spotted his own photo and called police. Parents with children who have been missing for a long time are especially grateful to have their child featured in gas pump videos.

So please, as you head out for Thanksgiving, please look at the young faces if they’re featured on your gas pump. Their parents will be so grateful.

Media Buying Briefing: How buyers see Q4 scatter activity affecting 2022 spending across TV and digital

IVY LIU

By MICHAEL BÜRGI, Digiday

Although the fourth-quarter national ad marketplace has shown some softness due to both media-related and external factors, for the most part there’s enough momentum from advertisers wanting to spend the last of their 2021 ad budgets to enter next year with some momentum. Whether that momentum can be sustained throughout 2022 remains to be seen.

A check-in with a handful of heads of investment at major media agencies reveals that some big clients who purchased upfront inventory at steep increases in cost-per-thousand viewers (CPM), have exercised their “options” to return some of that inventory to the networks they bought it from. That’s dropping the rates for Q4 scatter inventory, although they are said to remain above upfront pricing.

“As much as we’d like to think the pandemic has ended, there’s still pressures from the pandemic that exists on certain entities,” said Geoff Calabrese, chief investment officer for Omnicom Media Group.

Cara Lewis, executive vp and head of U.S. investment for Dentsu, said she hasn’t seen a significant pullback in spending among her clients, but “some had to [exercise options] for business purposes. In terms of scatter, some brands need to buy and pick off some individual inventory as needed, but I haven’t seen a flooding of the marketplace — I’ve heard it’s pretty soft.”

Specifically, some automakers are said to have returned TV inventory, as a result of lingering chip shortages that’s inhibiting the production of new cars. Pharmaceutical advertisers, a mainstay of linear TV advertisers, are also said to have pulled back a bit due to the increase in Telehealth appointments consumers are making. And movie studios, while spending more than they did in 2020 (when theaters were closed for the most part), are still holding back some spend since box-office results haven’t recovered as much as they would like.

Within linear TV, the last remaining source of strength remains in live sports, whose ratings have generally bounced back following serious dips in tentpole sports events at the height of the pandemic. “We have seen live sports continue to be extremely popular,” said Calabrese. “Advertisers are still interested in big events such as the Super Bowl and the Olympics. The rest of spend flattens out a bit when you have such dominant programming.”

Surprisingly, the rest of linear TV viewing hasn’t dropped off as precipitously as it has in recent quarters, said Dave Campanelli, executive vp and chief investment officer at Horizon Media. “The linear networks aren’t in as dire a situation” as they were in 2020 or even before. Yes, ratings are down across the board, he added, but the networks were more accurate in guessing the drop-off. “This quarter it’s different than in recent years when they were too optimistic in their estimates,” said Campanelli.

Still, the rest of the video environment, from connected TV and streaming to digital out-of-home video to even user-generated content, appears to be benefiting the most from any advertiser pullback on linear TV, whose audience continues to erode. “The shift to digital has accelerated, and there’s just not really any appointment viewing anymore,” noted Lewis.

“We’re getting bought out of broadcast upfront commitments, out of scatter video money, out of digital dollars,” said Sean Mccaffrey, CEO of GSTV, a video network in service stations across the country. “I have zero ego about how we’re budgeted or what we’re called. We’re just trying to build solutions for partners.”

“We’re seeing a lot of dollars move to user-generated content through connected TV,” said Calabrese. “We’re seeing it go into social and influencer spend, and from [broad-reaching] influencers to minority influencers , which is a huge initiative for us.”

How will these factors translate to marketplace momentum — or lack thereof — going into 2022? For one, Horizon’s Campanelli said he hears a lot from clients about supply-chain problems possibly affecting their spend next year, but “I don’t foresee any meaningful impact,” whereas concerns over inflation are more credible, but “it’s too early to tell what impact that might have.”

“It’s going to be a strong marketplace, we just don’t know the true supply [of inventory] just yet,” said Dentsu’s Lewis. “Now that we’re seeing a softer fourth-quarter marketplace, we’ll see how well we predicted the ratings for next year.”

Color by numbers

According to the latest stats issued by ECI Media Management, North American media prices are expected to rise 3.8 percent in 2021, which is higher than the 2.9 percent predicted at the beginning of the year.

ECI also bumped up its estimates for global media inflation in 2021 to 4 percent, from 3 percent predicted earlier this year.

Finally, ECI estimates that for 2022, global offline media prices will rise 3.4 percent, while online media will rise 3.3 percent.

Takeoff & landing

Ad management firm Mediavine, which partnered with minority-owned Colossus SSP in July to increase investments in minority-owned content through the programmatic sale of inventory in those channels, said Colossus SSP now ranks in the top 10 monetization platforms and is the highest performing partner of Mediavine’s in the last 18 months.

Female owned-and-run independent shop Media Matters Worldwide was named media AOR for Glassdoor, handling the jobs and companies app’s omnichannel strategy, communications planning, analytics and data visualization, effective immediately.

A few key industry executives are retiring: Jane Clarke, longtime head of the Coalition for Innovative Media Measurement, is stepping down and being replaced by Jon Watts, the co-founder and executive director of the Project X Institute. And ANA’s main man in Washington, DC, group executive vp Dan Jaffe, is retiring, to be replaced by senior vp Christopher Oswald.

Direct quote

“There is so much existential dread as well as opportunity right now around where to find video impressions and reach and scale. If you’re coming from a linear lens, [you’re thinking about] where to find targeting and measurable audiences. And if you’re coming from a digital background (whether it’s CTV, or digital out of home or online video), a lot of the debate is around how do I buy it and the challenges with buying it? Versus probably the more important question: why am I buying it?” We keep hearing back at us, ‘I still care about right place, right time, right moment, right context.’ But what’s the mindset of the consumer and can I get across to it?”

—Sean McCaffrey, CEO of out-of-home video network GSTV, talking about shifting attitudes toward video among media buyers.

The new milk carton: Gas stations post ads to search for missing children

ADAM, an automated program that distributes missing children posters, has recovered hundreds of kids.

Missing children used to appear on milk cartons across the U.S. as part of the National Child Safety Council’s awareness campaign, which ran from the mid-1980s to the mid-1990s, before the Amber Alert system was created in 1996.

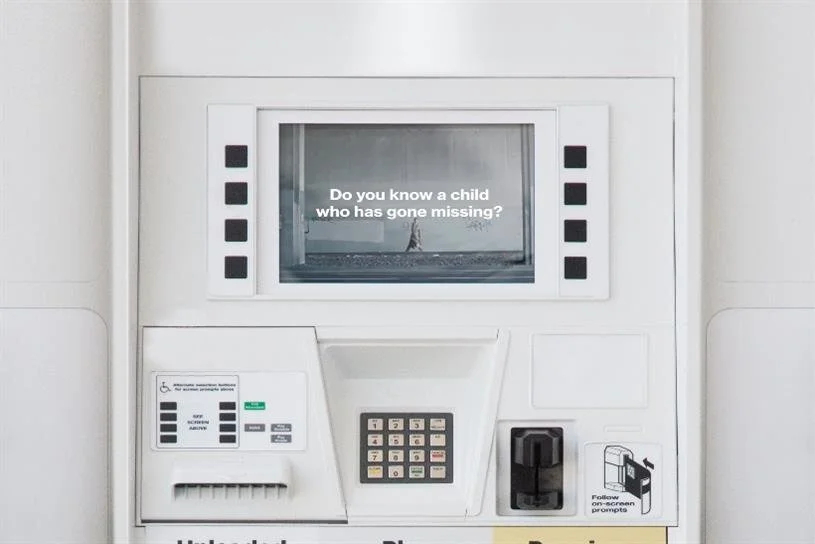

Fast forward to 2021, and The National Center for Missing and Exploited Children (NCMEC) wanted to revive the milk carton idea for modern times, using today’s technology.

So the organization partnered with GSTV, a national media network in 26,000 U.S. gas stations, on ADAM (Automated Deliver of Alerts on Missing Children). The program is named in memory of Adam Walsh, the 6-year-old son of America’s Most Wanted host John Walsh and brother of Callahan Walsh, executive director, FL, National Center for Missing & Exploited Children. Adam Walsh was abducted from a mall in Hollywood, Florida in 1981 and later found murdered.

ADAM, created with data analytics company LexisNexis, distributes missing child posters from NCMEC to targeted screens at gas stations in specific geographic search areas. Once a child is recovered, the images are taken down to protect the family’s privacy and replaced with images of another missing child.

Gas stations are a strategic location to advertise, as missing children are often spotted there as predators stop to refuel. Tips from ordinary citizens have been proven to be the most effective method for recovering missing children.

“We want to show the images of missing children in the places where they're likely to be found to increase the probability that someone will recognize them and make that call,” Callahan Walsh told Campaign US.

NCMEC has worked with GSTV, which reaches 96 million people in the U.S. monthly, since 2019. Over that time period, campaigns have delivered over 600 million impressions across thousands of stations in 48 states, adding up to more than 2 million hours of airtime. Nearly 500 missing kids have been located at fuel retailers and convenience stores in the past six months.

“We take a lot of pride in being able to have a platform that we can leverage and do good,” said Violeta Ivezaj, senior vice president of business operations at GSTV. “It's not just about advertisements and entertaining, but taking the opportunity to engage our viewers at a time where they're extremely attentive. There isn't a whole lot to do when you're pumping gas.”

GSTV is recruiting employees from GSTV’s more than 40,000 fuel retail partners as well as trade associations for convenience stores, manufacturing partners and major oil companies. Staff also receive alerts at locations where there is a high likelihood of a predator who has abducted a child stopping to refuel.

“A light bulb went off and we thought, ‘What if all of the clerks and the people working at these stations are receiving the same alerts to their phones,’” said Dan Trotzer, executive vice president of industry at GSTV. “They became the eyes and ears in their communities looking out for the safety of our kids.”

Child abductions have increased over the last year, especially as the pandemic forced schools to shift to remote learning. With more kids being educated online, the rate at which predators use digital technology to find new victims increased nearly 100%, according to NCMEC.

In 2020, car thefts also increased, with thieves unknowingly abducting children from cars that were running in driveways, gas stations and convenience stores.

Since starting their partnership, GSTV and NCMEC have recovered 148 out of 223 children across their media campaigns.

“When you reunite missing children with their loving family, it's better than a home run, it's better than a Grand Slam,” said Callahan Walsh. “There's nothing like that in the world.”

Comscore Pumps Up New OOH Measurement Service, Signs GSTV

By Joe Mandese, MediaPost

A year after Nielsen left the field of digital out-of-home media measurement, one of the field’s highest profile suppliers, GSTV (Gas Station TV), has signed with Comscore to utilize its fledgling place-based media audience measurement service.

As part of the agreement, Comscore said it will report digital ad impressions, reach and frequency for each market and demographic GSTV sells as part of its national video advertising network.

GSTV, which is distributed across tens of thousands of gas stations nationwide, will have its audience estimates accessible via Comscore’s media ratings via its Plan Metrix Multi-Platform planning service in the U.S.

Both GSTV and Comscore are members of the Digital Place-Based Advertising Association (DPAA), which has been encouraging innovative solutions to place-based media measurement ever since Nielsen abandoned the market in September 2020.

It also includes Comscore rival Epicenter as a member, which has already begun supplying audience measurement estimates to two other DPAA members: national cinema advertising networks National CineMedia (NCM) and Screenvision.

GSTV already has a preexisting relationship with Comscore, which previously conducted proprietary campaign effectiveness research quantifying the effect of GSTV’s ad exposure for marketers and comparing it with outcomes like TV and website visitation lift.

Comscore, which announced its new digital out-of-home measurement service earlier this year, in May unveiled its first customer, the Lightbox OOH Video Network.

GSTV Picks Comscore For Digital Out-Of-Home Viewer Measurement

Comscore will report reach and frequency by market and demo

Comscore announced it made a deal with GSTV to measure viewing of its video network at gas stations.

Comscore will report on digital ad impressions, reach and frequency by market and demo.

"We're thrilled to be partnering with Comscore to offer advertisers trusted, third-party reporting on the scope and scale of GSTV's national viewership," said Eric Z. Sherman, executive VP, Insights & Analytics, GSTV. "We share Comscore's commitment to transparent, accountable measurement for video across all platforms, wherever it is viewed."

GSTV and Comscore have already been working together to measure campaign effectiveness by linking GSTV ad exposure to TV tune-in and website visit.

Comscore said its new digital out-of-home measurement is being integrated into its Media Ratings system and can be used as part of its Plan Metric Multi-Platform campaign planning tool.

"We are excited to deepen our partnership with GSTV by providing granular insights into consumer behavior at fuel retailers nationwide," said Gary Warech, executive VP, Comscore. "As a recognized leader in DOOH, GSTV's addition to the Comscore family further illustrates our commitment to the industry."

Media Buying Briefing: The shift to programmatic in digital OOH creates ‘muscle memory’ for an outlier industry

By Michael Bürgi, Digiday

For better or worse, out-of-home (OOH) media has always been an outlier of sorts relative to TV or digital, from both a buyer and seller perspective. It was largely seen as a local medium, and approached for its locational value rather than quality of audience.

However, the steady advances OOH media companies have made to convert to digital inventory — incorporating digital video, dynamic signage and other forms into their offerings — have enabled the industry to incorporate programmatic into the buy/sell process. And the toehold programmatic has secured in digital OOH (DOOH) is shifting perceptions and pushing the medium into greater consideration for omni-channel media buying and planning, as a result of it being evaluated as audience-driven as much as a location-based buy.

One sell-side executive described programmatic’s effect on DOOH buying as “creating muscle memory” in that it’s more measurable and targetable alongside other media than it has ever been before

Programmatic currently accounts for only about 10 percent of all DOOH inventory, but media buyers and sellers agree that number will surge as media agencies strike alliances with programmatic providers and DSPs.

“Programmatic will become much more important within digital out of home,” said Ameet Shah, partner and vp of publisher operations and technology strategy at Prohaska Consulting. “Audience [as a means of assessing OOH] has always been there, but never was the focus because it was hard to transact and put in place.”

One agency holding company is putting those assets into partnership for mutual benefit. Digiday has learned that GroupM has quietly cranked up its Sightline partnership, which pairs the programmatic abilities of its Xaxis unit with its OOH media agency Kinetic Worldwide. The partnership was formed a year ago, just before the COVID pandemic forced large-scale lockdowns across the globe, so it never quite got off the ground until recently.

But Michael Lieberman, Kinetic’s U.S. CEO, said Sightline has run efforts for 22 clients this year (he declined to name any specific clients), attracting new business from CPG, retail, finance and national auto advertisers. “National advertisers, who may have looked at us for a heavy-up in one or two markets, are now thinking of us as an audience platform that can sit alongside their video, their display, their connected TV, or audio [buys],” he said.

“We’re able to attack budgets from both sides,” added Gila Wilensky, U.S. president at Xaxis. “This lets Xaxis unlock more out-of-home dollars and for Kinetic to finally offer programmatic — previously neither of us had access to this.”

Programmatic’s adoption among OOH media agencies will continue apace. “We typically use managed service, partnering up with DSPs,” said Chris Olsen, U.S. president of IPG’s OOH media agency Rapport, who noted the agency has bought more inventory programmatically to date this year than any prior full year. “In the second half of 2021, we’re looking to have our own programmatic division within Rapport,” he said.

As more digital OOH media firms build out the reach and sophistication of their technology, they see significant opportunity to work OOH into consideration sets alongside other media from the buy side — especially when programmatic becomes the tool used on both ends.

“It’s helping reverse-engineer audience thinking and audience transacting,” said Sean McCaffrey, CEO of GSTV, which runs a network of video screens at gas station pumps. “That’s one of the key drivers of its growth and acceptance. I can think about audience in out of home not just as LaGuardia airport or the 405 freeway, but as Chevy drivers, kids in the household, golfers — the same way I’d think about audience in other digital media.”

Still, obstacles remain in place — not least of which is that the majority of OOH inventory (more than 60 percent, one source estimated) remains non-digital. There’s also the issue of third-party data deprecation and mobile providers’ limits on tracking users. Just as the DOOH embraces programmatic, some sources of data could end up limited.

But even here, industry executives are split on how significant an impact data deprecation will have.

One one side, both Kinetic’s Lieberman and Rapport’s Olsen acknowledged that a dropoff in third-party data, particularly location-based data, could throw a curveball at the insights needed to power effective use of programmatic.

But Prohaska’s Shah said he sees upside relative to other digital media. “Look at what’s important — context, value, audiences. Digital out of home remains fundamentally unchanged in the level of data [it needs] … So by default the value of this inventory goes up.”

Color by numbers

It’s seemingly impossible to have a conversation in media or marketing without bringing up third-party cookie deprecation. So it is with marketers and agencies, who named it their top challenge for 2021 in Adswerve’s most recent survey of 284 executives. Here’s how they responded and where other concerns fell in priority:

Decline of cookies/changes in availability of 3rd party data: 66 percent

Difficulty in providing ROI of data-driven programs: 35 percent

Business recovery from COVID-19: 29 percent

Siloed organizational structure/poor data-sharing protocols: 29 percent

Lack of internal experience/talent: 24 percent

Limited budget/lack of funding: 24 percent

Government/data privacy regulation: 15 percent

Takeoff & landing

Mike Bregman was named chief data officer for Havas Media Group North America, and will join the media agency’s leadership team. Bregman comes from Accenture’s Applied Intelligence unit, where he was global managing director overseeing customer, marketing and sales analytics.

Omnicom’s PHD USA hired Sarah Clayton as its first head of commerce, joining from drugmaker Bayer, where she was U.S. marketing director.

Playbook Media, a full service independent agency, partnered with measurement service TVDataNow to offer clients media buying and management, as well as measurement and performance optimization to clients looking to spend in the CTV/OTT space.

Direct quote

“We’re not just marketers … we’re storytellers. Has anyone mentioned that today? We’re storytellers. In fact, we’re telling you a story right now. Not a true story … the story we’re telling, you know, is completely made up. But what do you expect us to do? Tell the truth?”

— Late-night host Jimmy Kimmel, during Disney’s upfront presentation to media buyers last week.

Speed reading

Missed last week’s upfronts presentations? Then you’ll want to read Digiday senior media editor Tim Peterson’s Future of TV Briefing, which analyzes the impact on streaming of the surprise WarnerMedia/Discovery Communications merger, and offers a cheat sheet on all the major presentations.

Digiday’s platforms, data and privacy reporter Kate Kaye details Publicis Media’s efforts to more effectively evaluate data and tech partners, as a means to rooting out negative cultural or racial stereotypes.

Venturebeat looks into the gains Google’s Android ad sales platform is enjoying in the early days after Apple’s IDFA implementation.

GSTV Seeks Great Creativity for Its Video Network at Service Stations

Sean McCaffrey on the growing platform's approach

Last Halloween, service stations across the country jolted millions of consumers as they filled their tanks. On GSTV’s nationwide network of pump-based screens, video host Maria Menounos morphed into a freaky, threatening dude via deep-fake technology. The segment hyped a hair-raising digital experience from filmmaker Jason Zada exploring the dangers of rampant data collection (and updating themes from his viral "Take This Lollipop" effort a decade ago).

The stunt generated 18.4 million impressions in 11 days, illustrating GSTV's ability to reach a captive, highly diverse audience.

"It was a flash of 'What did I just see!?' It got viewers buzzing," recalls GSTV president and CEO Sean McCaffrey. "As a national video network, we want to entertain and inform our viewers, while in this case also highlighting very real concerns."

McCaffrey joined the network at its 2017 inception, driving growth by developing snackable content for folks on the go, and enticing advertisers to come along for the ride. His road to the future runs through some 25,000 current locations—double the number at launch. By year's end, another 5,000 stations should come online.

With McCaffrey at the wheel, the network, which reaches roughly one in three Americans each month, "has transformed every area of the business, from the content experience to the depth and breadth of advertisers that partner with us," he says. "We've also solidified our product offering and improved the tech platform by which it's delivered. Every change was led and informed by listening to our audience."

For example, GSTV carries food hacks from So Yummy and music news produced by Live Nation and Loop Media because "those who fuel up tend to be on their way to eat or to a drive-thru, and many consumers are also listening to music in their cars," McCaffrey says.

"Loop's short-form gaming and music content is perfectly suited for GSTV's captive platform format and audience," says Greg Drebin, Loop's marketing and content chief. Loop airs a segment each week with snippets from trending music videos and video games.

Other providers powering the network's stream include Cheddar News, Stadium, Wave.tv and What's Trending, along with GSTV's own Ignite creative studio, which develops original programs. Podcast star Menounos joined the lineup last summer, covering lifestyle, health and celebrities. Some programming runs seasonally, notably sports highlights. Regional targeting also comes into play, with the network's Octane analytics arm leveraging data from Claritas, Dstillery and the U.S. Census Bureau to craft flexible, targeted brand opportunities based on demographics and consumer behavior.

Shooting for the MoonPies.

"We don't consider ourselves parallel to other platforms out there," such as screens in taxis, trains and airlines, or Clear Channel Outdoor, where McCaffrey spent 16 years overseeing strategy, marketing and partnerships, he says. Instead, he views GTSV as a hybrid, fusing "broadcast's reach and scale with the targeting and measurement capabilities of digital, and the real-world opportunity of mobile and out-of-home media."

Because so many different types of people criss-cross our nation's roadways, the network can help brands reach commuters and travelers of varying ages, backgrounds and ethnicities "at a moment they are both paying attention to advertising, and on the path to purchase," he says. "We work with partners to message at the lower end of the funnel with calls to action directing viewers to a drive-thru or convenience stores—and at the higher end of the funnel, for low-frequency buys, like auto or financial purchases, building affinity through a routine weekly engagement."

One such low-end play took place on Super Bowl Sunday in 2020, when MoonPie and creative agency Tombras ran an 80-second commercial, reaching GSTV viewers as they picked up snacks for the game. Fittingly, part of the spot was set at a filling station.

"It got a lot of buzz because people thought it was a fun, irreverent idea—but for me, it was important because it was such a smart idea," says Tombras creative chief Jeff Benjamin. "We could have spent a gazillion dollars running a Super Bowl commercial on television, and it would have run for 30 seconds, one time during the game. Instead, we got so much more value running on those pumps."

All told, that campaign generated 5.3 million impressions in a single day.

"It cost less [than a Big Game buy], and we were able to engage with consumers over a much longer period of time," Benjamin says. "Plus, the audiences were steps from convenience stores, where MoonPies are sold. There was a dramatic sales lift on game day and for a period after that."

Doing good in Covid times.

While entertainment is key, the network's screens also broadcast critical information in times of floods, fires and natural disasters. "GSTV was a network situated on the essential front lines alongside our retail partners who never shut down and served as an essential source of fuel, food and information," McCaffrey explains.

At the height of Covid, GSTV delivered messages from the American Red Cross, the U.S. Centers fro Disease Control and Prevention and Feeding America, among others, while also thanking UPS workers and other front-liners for their service.

"GSTV has been instrumental in helping to extend the reach of our CDC PSAs in the OOH market, particularly during the past year," says Liz Johnson DeAngelis, the Ad Council's VP of growth and managed platforms. "When Covid first hit, they helped distribute life-saving messages around staying home and social distancing."

More recently, the network "stepped up to help support and amplify 'It's Up to You,' our vaccine education campaign," DeAngelis says. "They delivered relevant messages to Hispanic, Black and general market audiences in key markets using six different 15-second spots." That's a wide net—critical for driving vaccination participation en mass, Rushton says. In just a few months, GSTV's pro-bono support generated 48 million impressions.

At the same time, the service has expanded its partnership with the National Center for Missing and Exploited Children to share images of missing kids and help build a robust alert network with retail partners. "We know that recoveries can often happen at or near fueling and rest stops," McCaffrey says.

Driving into the future.

Of late, McCaffrey has shifted GSTV's own profile into higher gear. In March, for example, the brand joined with Muse by Clio to become the presenting sponsor of Tagline, a podcast that tells the stories behind legendary ad campaigns.

"One of our goals is to work more closely with creatives and creative shops," McCaffrey says. "We're a network that is poised for creative storytelling in a unique consumer context. We believe we are one of the increasingly few places you can get real reach and be in the 'right place, time and moment' … and without skipping, blocking and interruption."

Reaching "ad nerds"—passionate folks at agencies and brands on creativity's cutting edge—is essential because GSTV views itself as a robust resource, capable of real innovation. Wild ideas and bold directions—such as "Take This Lollipop 2" and MoonPie's Super Bowl spot—are welcome, if they work across the three to five minutes users typically spend filling up, McCaffrey says.

With summer fast approaching, and the U.S. emerging from the pandemic, McCaffrey's 2021 plans include a renewed push for vacationers' attention with GSTV's "Great American Road Trip" series, a wide-ranging celebration of travel and discovery, produced in-house.

"The series has integration opportunities built in for clients and opens up natural opportunities for brands and categories that contribute to a memorable road trip—travel and tourism, of course, but also QSRs, CPG, automotive, etc.," he says. "Our team is always looking for the next great creative campaign, and we want to be a partner in helping clients explore and push the boundaries on the possibilities with our network."

As Americans leave major cities, will outdoor ads follow?

By Kenneth Hein, The Drum

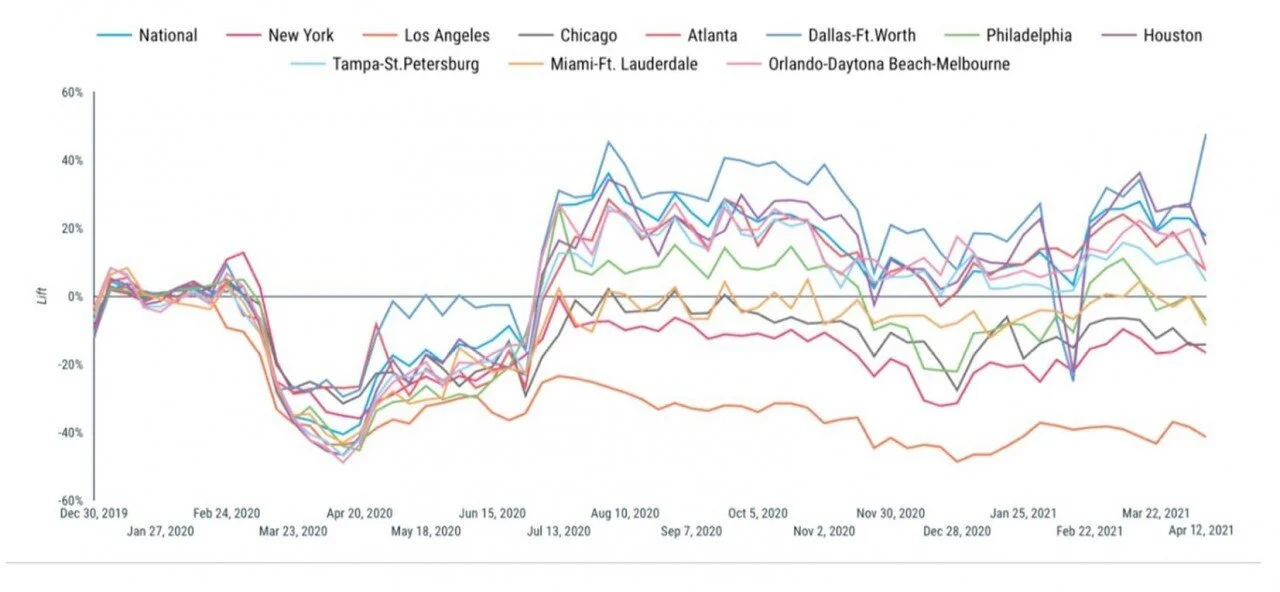

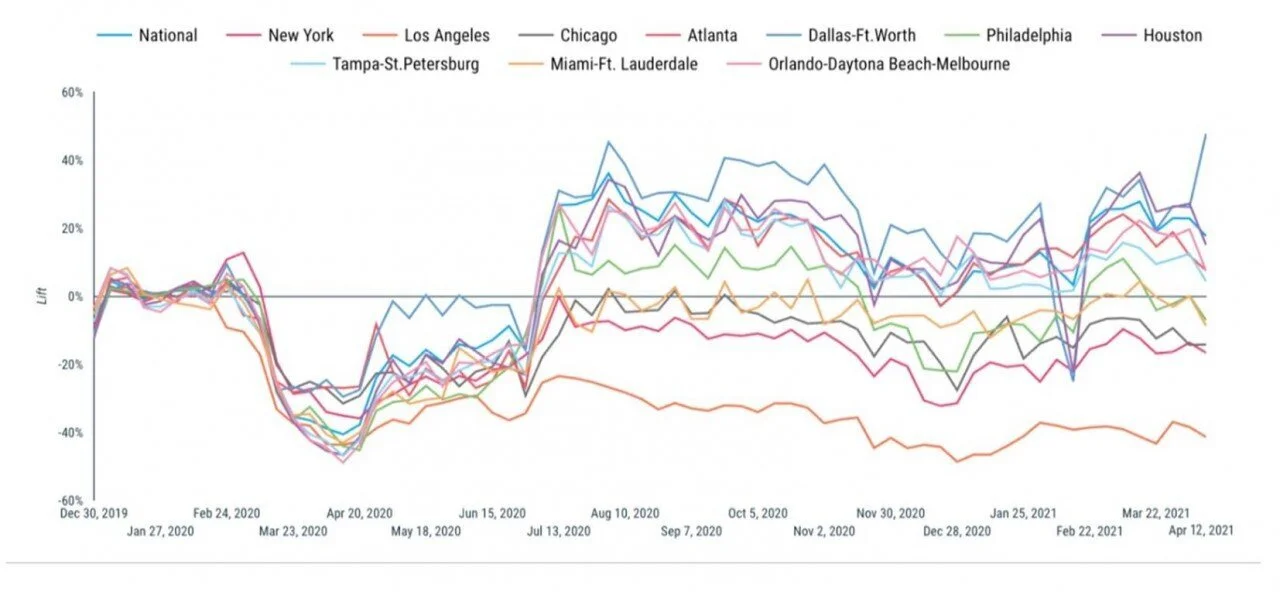

Buying out-of-home ads used to be so simple. Buy the top-10 markets and you were covered. Now, as a significant part of the US population has scattered across the country like dandelion seeds in the wind, marketers must be more thoughtful about their approach. While media buyers say brands may be slow to make the shift to buying secondary markets, the much-anticipated rise of digital out-of-home just might prove rewarding for early adopters who are following the trend.

Every other license plate in Florida is from New York, remarked a media buyer recently. This observation is part of an undeniable trend: many US consumers have migrated to secondary cities. Many may not return.

This adds a new and significant level of consideration to any marketer looking to make an out-of-home (OOH) buy as the US continues to open up. While purchasing OOH ads in the top-10 markets (like New York, Chicago, Los Angeles and a handful of other key metro areas) used to be the only box a marketer needed to check, things have changed – even if clients haven’t recognized it yet.

Today, cities like Austin, Santa Barbara, Nashville, Indianapolis and Denver must be considered, per Ubimo, a Quotient Brand. Each of these cities saw the largest increase in movement, around 340,000+ OOH properties nationwide for the week ended April 4 compared to pre-Covid.

Other cities that saw increased movement include Charleston, South Carolina, Boise, Idaho, Columbus, Ohio and Cheyenne, Wyoming – all of which are also experiencing a population influx due to relocations.

And then there’s Florida. The Sunshine State’s real estate market has been described as a circus. Paul Ryan, the former Speaker of House, says there is going to be a ‘big migration’ from New York to Florida and Texas thanks to lower taxes outside the Big Apple. Jacksonville, Florida, also saw great gains, according to Ubimo data. Gas Station TV (GSTV), which offers ads at the pump, ranked Jacksonville as the third-largest gainer in transaction volume.

The most popular spot per GSTV: Bozeman, Montana, where apparently the locals can’t find a place to live anymore because of all the Californians moving in. Bangor, Maine stole the second-place spot.

Suffice to say, many people aren’t just in the top-10 market demographics anymore. (Further proof of this fact in the Ubimo chart below.) So, what are marketers and media buyers going to do now that OOH ad spend is coming back?

An inflection point for outdoor advertising

There is no shortage of bullish research indicating that OOH ad spend will rebound. Group M, for example, predicts outdoor will grow 22.4% this year, 19.7% in 2022 and see single-digit growth in 2023.

When Angela Zepeda, chief marketer at Hyundai Motor America, worked out her launch plans for the new Tucson, OOH found its way back into the marketing mix. “Car buying is up. People are antsy and want to get out ... we are dipping our toe back into some of these OOH channels and formats where we couldn’t spend in last year. Now we’ve got these important launches to do, and we just need to be everywhere.”

Zepeda stuck with the major metros with a key focus on Dallas, Houston and San Antonio, Texas – all of which are big markets for Hyundai.

The return to OOH spending, in any market, is good news for a category that was crushed by lockdown. “Advertisers are gearing up coming out of a relatively soft Q1. I think it’s going to be a big Q2,” says Norm Chait, group director of OOH sales for Quotient, which owns Ubimo. “We are seeing re-emergence in larger markets and movement in lots of secondary cities.”

But given the migration at hand, will marketers’ media plans begin to reflect the new realities? Media buyers say it’s possible, but it won’t happen quickly. Martin Porter, head of OOH at Dentsu, says, “It depends on client and vertical. For automotive there could be bigger changes. If you move out of cities, you’re more likely to buy a car.”

Still, there are questions about the current patterns and whether the dispersion of urban dwellers is permanent, says Porter. “Once is a blip, twice is a coincidence and three times is a trend. We are in a blip or a coincidence moment, so clients are not shifting big chunks of New York or Los Angeles dollars to secondary markets yet. It will be an inflection point this summer. Will migration paths change?”

Digital OOH gains ground

While marketers may still be sold on major markets, at least for the time being, they are also becoming more receptive to digital out-of-home ads (DOOH). Digital signage options at gas stations, supermarkets, electric vehicle charging stations, malls and commuter hubs had been gaining steam until everyone was stuck on their sofas for more than a year. The allure is simple: marketers can swap out creative based on location, the weather or any of a number of other different factors. They can also measure, test and learn.

Hyundai’s Zepeda says: "Digital boards and programmatic buying just allows for a lot more flexibility. It allows us to change messages more rapidly or tailor those messages to that particular market. Anything you can do to be more relevant that speaks to a customer and their mindset or their voice, the better off you are. It feels like your brand understands them.”

It also allows marketers to reach secondary cities more easily. “There is more flexibility to be reactive, to optimize and be efficient,” says Helen Miall, chief marketer at Viooh, global programmatic digital out-of-home marketplace. “You have the ability to change as audiences move around. You’re no longer fixed to a specific location and you can use the data to make decisions as the audiences are changing.”

Barry Frey, chief executive of the DPAA, the global digital out-of-home trade and marketing association, says being able to ‘follow the audience’ is essential because of two key factors. “The trend is people want to be outside. You can’t hold people back. That trend is our friend. Also, we aren’t impacted by the disappearance of the cookie. We have our own good data. For us, if there’s no cookie, no problem.”

The dawn of the national outdoor ad buy

Marketers will always be drawn to the big, shiny vanity play buys like Times Square and Sunset Boulevard, but as DOOH advances, so does the opportunity to be much more pervasive. In fact, making national buys, which had previously been difficult, is now likely to accelerate.

Over the past couple of years, there has been a ‘connecting of the pipes’ that allows DOOH buyers to offer a national footprint. “You will see an increased share in other markets as we start pushing forward with more of a national offering,” says Michael Lieberman, US chief executive at Kinetic Worldwide. For marketers looking to broaden their reach, it’s less about adding cities and more about “thinking about what we can do on a networked basis. That’s the massive change we need to undergo as an industry – getting people to look outside of top-10, -15 or even -20 markets and thinking nationally”.

Keith Kaplan, global chief executive at Kinetic Worldwide, adds that the buying nationally also gives brands the chance to be always on. “You can always be there when they are ready to buy. You can be in front of them for the first mile and the last mile. It’s going to sound ridiculous, but this is a completely different shift in what OOH can be used for.”

Indeed, there is a lot to be optimistic about, says Dentsu’s Porter. “We are definitely seeing clients not just coming back and saying, ‘I will buy what I bought before.’ They are fully aware that people are moving around in different ways. Programmatic helps marketers target and optimize so much easier. This an inflection point in that channel ... OOH is on an upward trajectory.”