Predicting Consumer Spending: the surprising relationship between fueling up and shelling out

Predicting Consumer Spending: the surprising relationship between fueling up and shelling out

Marketers are obsessed with finding exactly the right audience for their advertising. Often overlooked, however, is finding the right moment. Ads delivered right before a shopping trip have the potential to deliver outsized returns. But how can advertisers reach an audience just before spending?

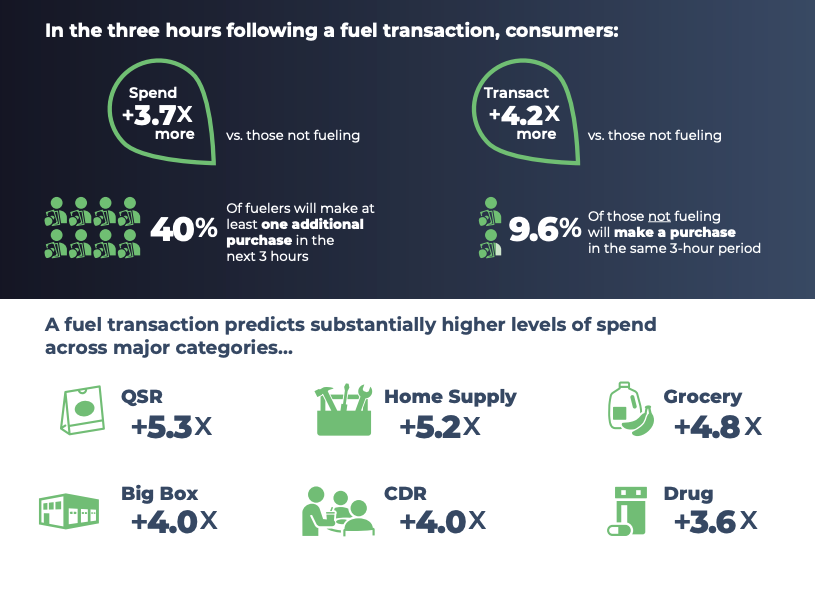

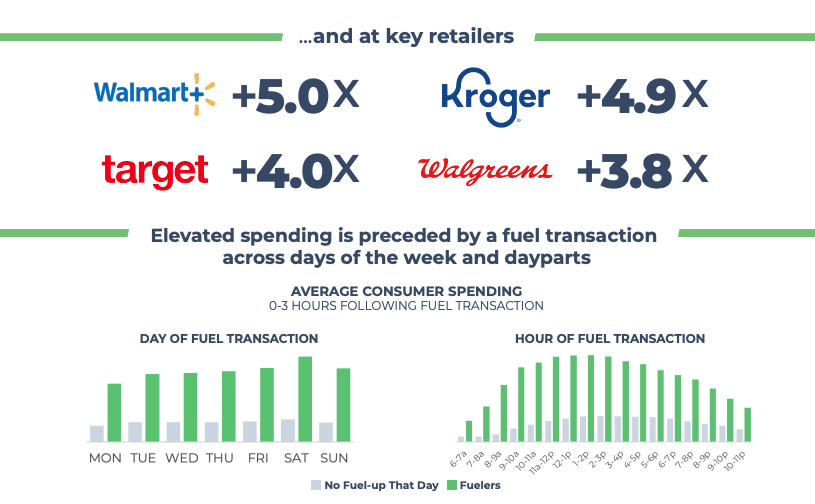

At GSTV, we hypothesized that since consumers often stop for fuel as part of a larger shopping trip, a fuel transaction would be a good predictor of immediate future spending. To test this hypothesis, we worked with Affinity Solutions to analyze the spending behavior of 20 million active credit and debit card accounts in the 3 hours immediately following a fuel-up. Spend behavior was compared to accounts without an observed fuel transaction that day. Affinity looked at recent behavior (4/1-7/31/21) as well as historical data (4/1-7/31/19) for comparison.

Here’s What We Found

How has behavior changed?

Our analysis period came more than a year after the start of the COVID-19 pandemic, during a lull in cases following widespread vaccine availability, and prior to the uptick in cases from the Delta variant. How does this “new normal” of consumer behavior compare to the past? Affinity observed significantly higher post-fueling spend in 2021 vs. 2019. One potential explanation is that the pandemic spurred a long-term shift in consumer behavior toward fewer, more comprehensive shopping runs. Data from Catalina supports this theory: in May 2021, they observed -9% fewer shopping trips and +18% higher basket sizes vs. the same time in 2019.*

*“As COVID-19 Vaccination Rates Rise, Grocery Shopping Behavior Drammatically Evolves,” PR Newswire, 5/27/21.