GSTV and WAVE.tv Launch Partnership To Bring Unique Sports Content To National Video Network

With New Partnership Across GSTV Network, Popular Sports Media Company Expands Audience Reach And Distribution Outside Of Owned Platforms For First Time

DETROIT (January 11, 2021) – GSTV, the national video network entertaining targeted audiences at scale across tens of thousands of fuel retailers, today announced a new content partnership with WAVE.tv, the sports media company for today’s fan that reaches over 200 million viewers and receives 3.9 billion views monthly across its portfolio of media brands.

The partnership will include the distribution of unique and non-traditional sports highlights and user-generated content from six of WAVE.tv’s most popular media brands; “Benchmob”, “Buckets”, “Rage Quit”, “FTBL”, “Haymakers”, and “Jukes”. WAVE.tv will provide GSTV with dedicated content segments to air across the national video network’s 25,000 stations. With WAVE.tv’s Rage Quit, e-sports content will appear regularly on GSTV for the first time. The partnership also opens up new opportunities for GSTV and WAVE.tv to work with brands looking to connect with a Gen Z and Millennial audience through sponsored content partnerships.

“While our programming can be discovered across the core and emerging digital platforms where today's modern sports fans spend the most time, we are constantly looking for ways to grow the awareness of the WAVE.tv brand outside of social and digital,” said Brian Verne, Co-Founder and CEO, WAVE.tv. “This is the first time WAVE.tv content will be visible to a wide audience outside of our platforms. We are thrilled to be partnering with GSTV, who is the perfect fit for our short-form sports content, and cannot wait to highlight a variety of sports fandoms with their national network.”

“WAVE.tv has mastered entertaining its viewers with captivating short form content, which is perfect for GSTV viewers who give us a few of their undivided moments of their attention while on the go,” said Sean McCaffrey, President & CEO, GSTV. “We know our audience responds enthusiastically to sports, e-sports and UGC, and we’re delighted to share WAVE.tv’s content with them as well as provide new sponsorship opportunities to advertisers looking to reach a Gen Z audience that natively loves and regularly consumes non-traditional sports content.”

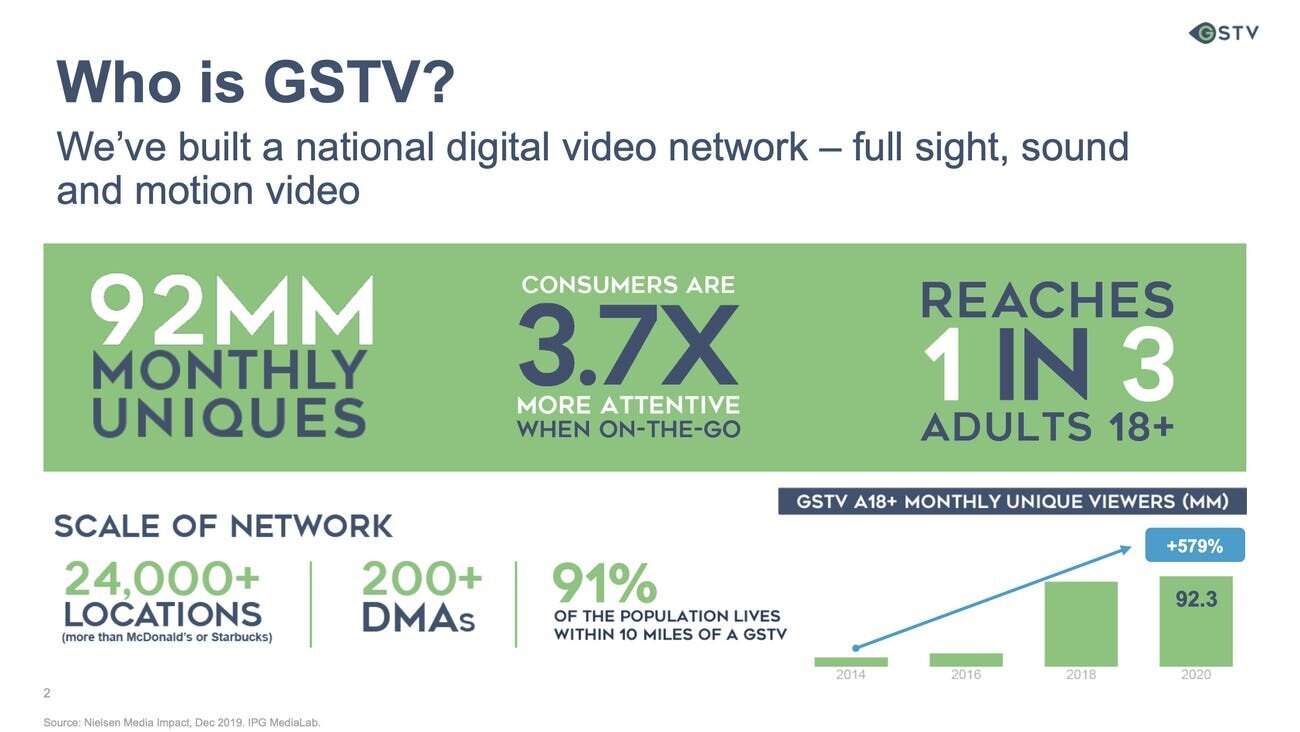

WAVE.tv joins GSTV’s growing line-up of premiere content partners, including Cheddar, Live Nation, Better Together With Maria Menounos, La Liga, Loop Media, First Media (So Yummy, Blossom), What’s Trending, CNET, Stadium, NFL and MLB, among others. The GSTV network reaches 92 million unique viewers a month.

WAVE.tv’s content segments can be seen on GSTV screens starting Monday, January 11. For more information about GSTV, visit gstv.com. For more information about WAVE.tv, visit wave.tv.

About GSTV

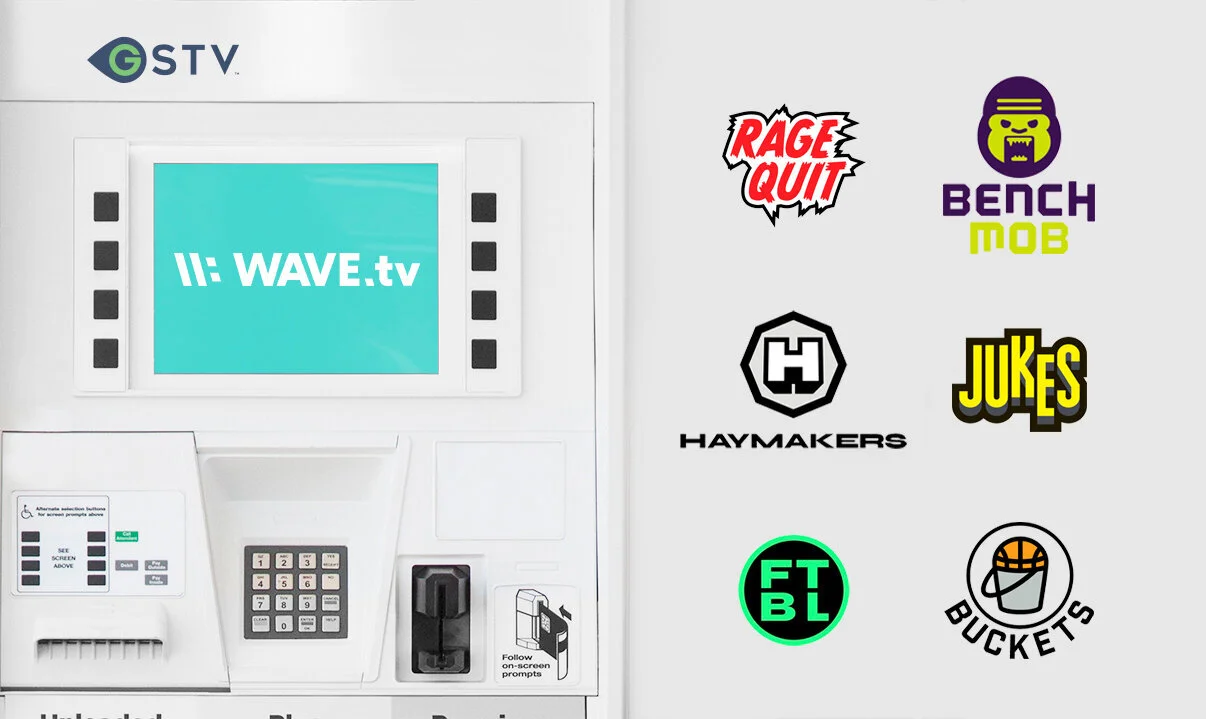

GSTV is a data-driven, national video network delivering targeted audiences at scale across tens of thousands of fuel retailers. Reaching 1 in 3 American adults monthly, GSTV engages viewers with full sight, sound, and motion video at an essential waypoint on their consumer journey. Analysis of billions of consumer purchases demonstrates that GSTV viewers spend significantly more across retailers, services, consumer goods and other sectors, following a fuel transaction. While offering consumers entertaining and informative content, GSTV drives immediate action and creates lasting brand impressions, delivering measurable results for the world’s largest advertisers. Visit gstv.com for more information and follow us on Facebook, Instagram, LinkedIn and Twitter.

About WAVE.tv

WAVE.tv is a sports media company for today's fan. Through a portfolio of media brands, covering a wide array of fandoms and genres, WAVE.tv entertains modern day sports fans with the programming they love, produced for the digital platforms where they spend the most time.

Their programming can be discovered across Snapchat, Instagram, TikTok, Facebook, YouTube and other core and emerging platforms. Each month, WAVE.tv's entire portfolio reaches 65 million followers and subscribers (largely Gen-Z and Millennials) with a unique reach of 200 million and generating over 3.9 billion video views.

Adweek: Deepfakes At The Gas Pump Scares Up Data Privacy Awareness

The video is part of a follow-up campaign to viral 2011 stunt 'Take This Lollipop'

By Patrick Kulp | Adweek

GSTV host Maria Menounos' face is replaced with deepfake technology. Take This Lollipop

Tens of millions of Americans filling their gas tanks this week may be in for a fright at the pump this season. No, it’s not about gas prices. Rather, it’s what is expected to happen from viewing a creepy campaign about privacy issues being shown on screens at the 24,000 Gas Station TV (GSTV) locations across the country.

The scene shows the friendly face of the TV anchor at the pump transforming into the villainous visage of a man with a sinisterly voiced warning about digital data collection.

The stunt, which involved using deepfake technology to replace the face of GSTV host Maria Menounos, is part of a new online privacy campaign that also includes a hair-raising Zoom video experience putting viewers in the center of a horror movie-like plot via their webcam.

The entire project is a belated follow-up to a 2011 viral stunt called “Take This Lollipop,” a Facebook app that captivated a more innocent generation of social media user with videos of the same ominous character reciting data about each viewer collected through Facebook’s data-sharing practices.

Creators Jason Zada, a film director, and Jason Nickel, a developer, said they hoped to reprise the success of that effort and the awareness it brought to Facebook’s data policies, but were waiting for the right cause.

“We took our time only because it really felt like we needed to find the right idea with the right piece of technology at the right time,” Zada said.

“It just so happened that a pandemic made that possible with this massive shift in technology and social communication–everybody started using Zoom,” he continued. “So the question was, ‘How can we use this current time in society in technology to our advantage and take something that we all rely upon, and and sort of twist it and turn it around a bit?'”

The result is an approximately 4-minute long Zoom video experience that detects your face and places the viewer in a Zoom call with three actors, two of whom—spoilers ahead—are spirited away by some unknown entity in suspenseful fashion before an augmented reality figure appears in the background of the viewer’s own room. The remaining participant then reveals herself to be the campaign’s trademark villain.

Zada and Nickel said the original goal had been to deepfake each viewer in real-time, but they couldn’t pull off the the technology in time for the launch. Instead, they decided to incorporate the deepfake element into a deal with GSTV and Menounos to hijack her regular segment with an ominous message.

“The general idea was that Halloween has been cancelled for the most part for a lot of people. Even brands have been shifting away from doing anything Halloween-related this year. And it seemed like the perfect opportunity,” Zada said.

“But you mix that with an election year in which there are these deep fakes that exist, there is AI, there is the hacking of the election, there’s the hacking of just general politics,” he added. “It was kind of interesting to look at how we could use deepfake in a more consumer-friendly way and show people that like, ‘I could access you–not your data anymore—but I could access you, I could recreate you, I could become you.'”

A recent survey of researchers ranked deepfakes as the number-one cyber-criminal threat posed by AI. Its nefarious potential extends beyond the creation of fake news footage of public figures–an oft-discussed threat that has yet to materialize in any significant way beyond YouTube gags, per deepfake tracking platform Sensity. Other areas of concern include identity theft, video call scam extortion and its most prevalent use as of a source of non-consensual pornography.

Despite those fears, advertisers have been latching onto the tech as a way to circumvent production constraints brought on by the pandemic or spread political messages.

Meanwhile, Facebook’s Cambridge Analytica scandal has made the issue tackled by the first “Take This Lollipop” campaign a critical national political issue that played a role in the 2016 election. Could they end up being as prescient this time around?

“We’ve always been a fan of just exploring future business models around content, entertainment and technology that I think we’re going to rely upon it more and more,” Zada said. “It’s a great time to be a storyteller, in terms of being able to use technology to power and enable original entertainment that breaks new ground.”

AdAge: 'Take This Lollipop' Returns To Teach A Creepy Lesson About Deepfakes

Jason Zada's viral Facebook app gets a follow-up featuring new tech scares

By I-Hsien Sherwood | AdAge

In 2011, a creepy Facebook app called Take This Lollipop went viral. It used private data captured by the platform to send viewers on a customized horror adventure, stalked by a tech-savvy villain who pinpointed the locations of their actual houses.

Now, nine years later, creator Jason Zada is back with a sequel that taps into the danger of a new type of digital technology: deepfakes. While advertisers and satirists have used the tech to fake words from world leaders, it isn’t only celebrities who can end up in seemingly compromising positions or appear to say things they didn’t. Consumer-level apps have been banned for faking nudes of women and underage girls.

In “Take This Lollipop 2,” Bill Oberst Jr. returns as the stalker, only this time he steals viewers' faces, showing how far the tech has come from its early days, when algorithms needed hours of footage of a person to emulate their features. "Take This Lollipop" is now a dedicated site that uses webcam footage to put viewers in the film, which looks like a video chat service, complete with an AI-powered interactive chat window. One-by-one, the other viewers meet a terrible fate

Zada directed the interactive short, which was built by Imposium and enlisted the skills of deepfake artist birbfakes. Promos feature Maria Menunous of GSTV.

Business Insider: A Gas Station Ad Platform Says Its Business Is Soaring in the Pandemic As Driving Picks Up. Here’s the Pitch Deck It’s Using to Win Advertisers.

By: Patrick Coffee | Business Insider

GSTV, which runs ad-driven videos at gas stations, has grown in recent months despite the pandemic's dramatic impact on the ad industry, according to CEO Sean McCaffrey.

Its pitch deck to advertisers makes the case that they can reach people in transit at a time when they're likely to spend money.

GSTV hopes to be an alternative way for brands to boost sales now that foot traffic is down and the status of big advertising events like live sports remains unclear.

Visit Business Insider's homepage for more stories.

The pandemic has people relying on their cars more than ever before — and advertisers want to reach them as they drive.

That is the central insight behind a pitch deck that GSTV used to return to growth by emphasizing the continued role that gas stations play in American life, according to CEO Sean McCaffrey.

GSTV is a private, nationwide network that provides an ad-driven video service to stations and convenience stores like Circle K and Speedway. Each day, GSTV releases an original clip of news, sports, entertainment, and ads that plays in front of drivers as they refuel.

McCaffrey said the platform, with 24,000 locations, reaches one in three American adults who are traveling by car.

GSTV is classified as out of home advertising, which accounted for $8.6 billion in spending last year. McCaffrey wouldn't share GSTV's revenue but said its clients include PepsiCo and that some brands have spent up to eight figures on the platform annually.

He said a key element of its appeal is that people spend far more money on the days they refuel, particularly at grocery stores, big box retailers, and fast food chains. And most also use their credit cards to buy gas and other items at the stations, creating anonymized first-party data that GSTV can use to target ads.

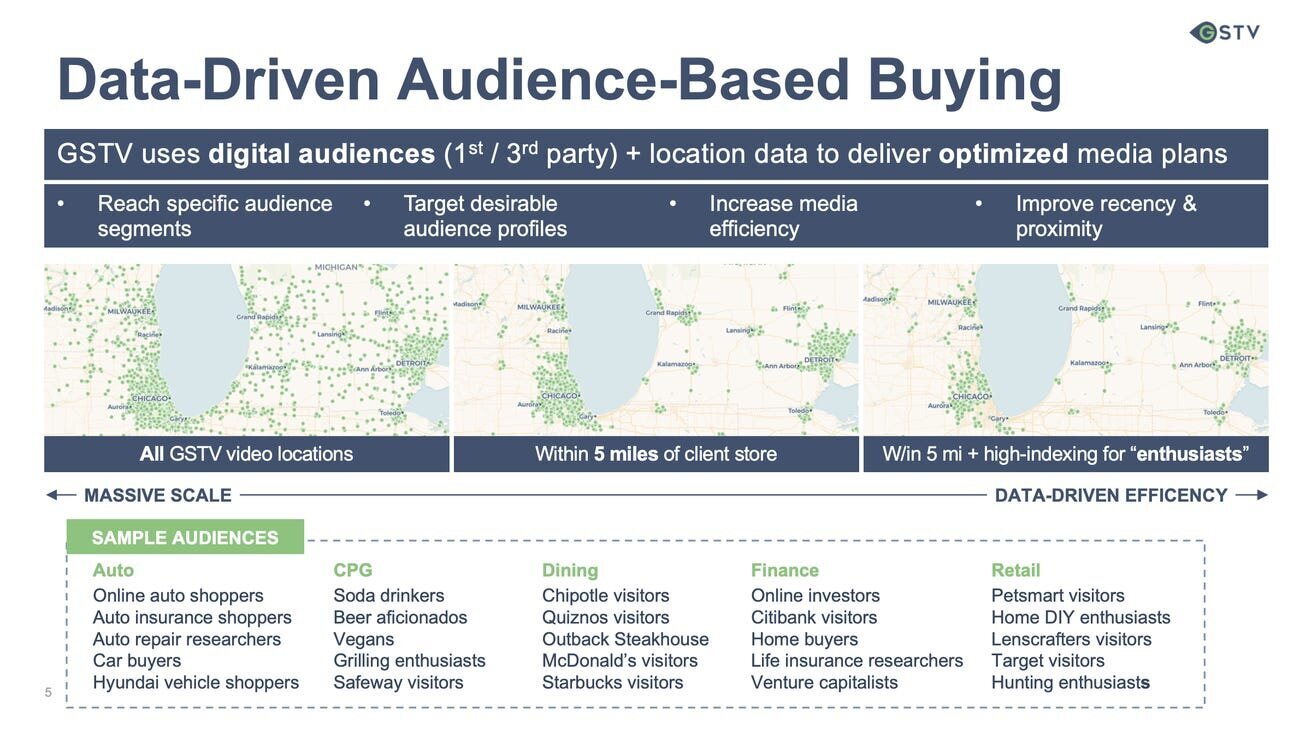

McCaffrey said the company then helps advertisers run hyper-local campaigns that promote nearby businesses or target the sort of people most likely to use a certain gas station based on both demographics and buying behaviors.

"We think of each station as an addressable household," he said.

GSTV hopes to fill a void left by the cancellation of live sports and other top ad spaces

McCaffrey said his company has weathered the effects of the pandemic and exceeded pre-coronavirus growth in recent weeks via the strategy outlined in the pitch deck GSTV has presented to media-buying agencies and brands.

"We've had more brand-direct conversations in the past six months than in the last two years," McCaffrey said. "Brands are generally taking more ownership of outreach because the market is so chaotic."

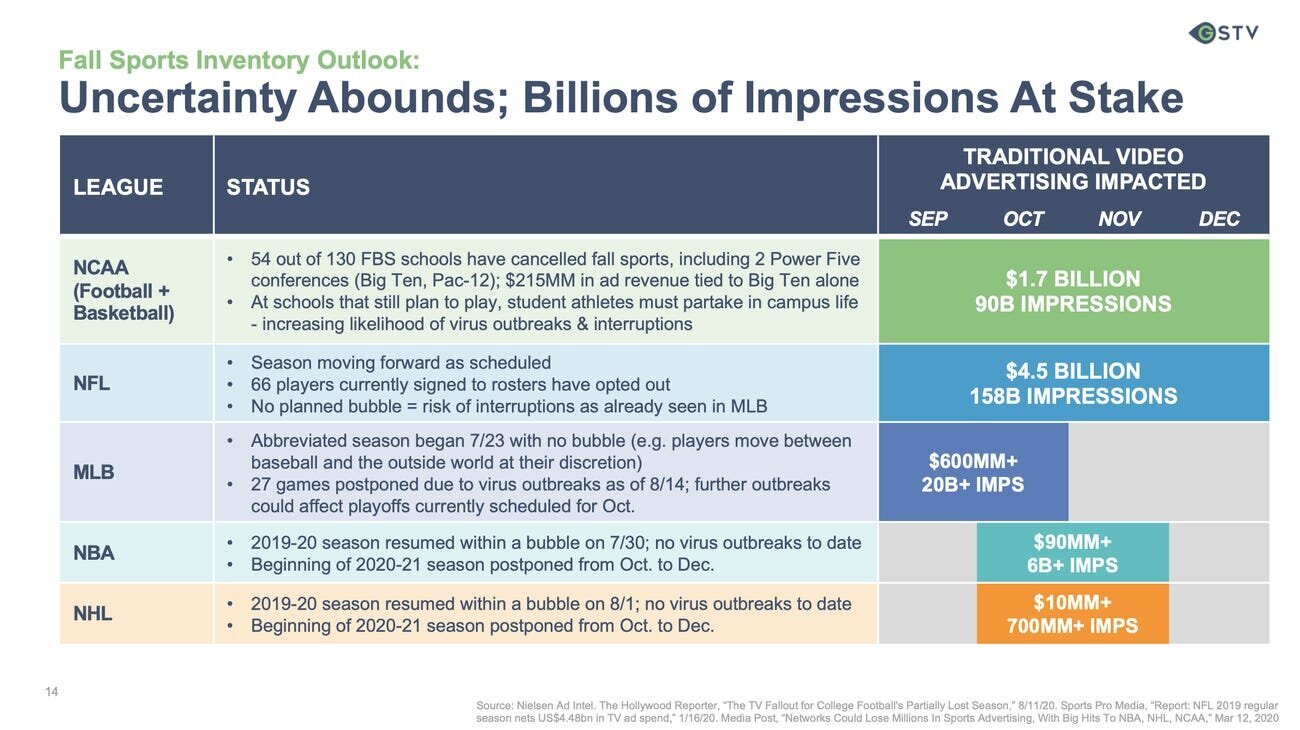

The deck also emphasizes the money left up in the air by the cancellation of major pro and college sports leagues to appeal to marketers who are under pressure to prove that their spend drives sales.

Another reason GSTV was less affected by the pandemic than some ad businesses, McCaffrey said, is that its audience included essential workers who were on the front lines in the earliest days of the quarantine.

The platform has also collaborated with the Centers for Disease Control and Prevention and the Ad Council in recent months, airing public health campaigns and PSAs encouraging consumers to frequent restaurants and other businesses.

The deck claims GSTV has more locations than McDonald's or Starbucks.

Partners include the NFL, Live Nation, host Maria Menounos, and news network Cheddar.

Data from Mastercard says customers spend almost four times as much at big box stores after filling their tanks than they do on days they don't fill their tanks.

The deck says Chipotle can use GSTV data to target people who live near a restaurant or whose demographics make them likely customers.

GSTV worked with IPG's Acxiom to target those most likely to own a particular brand of car.

Affordable gas has encouraged greater mobility amid lockdowns, according to the deck.

GSTV argues advertisers can reach Americans driving over the holidays as driving replaces air travel.

Its data shows consumers on the move spend more at each stop than they did pre-pandemic.

Spending at convenience stores is up more than 100% compared to the same period in 2019, the company says.

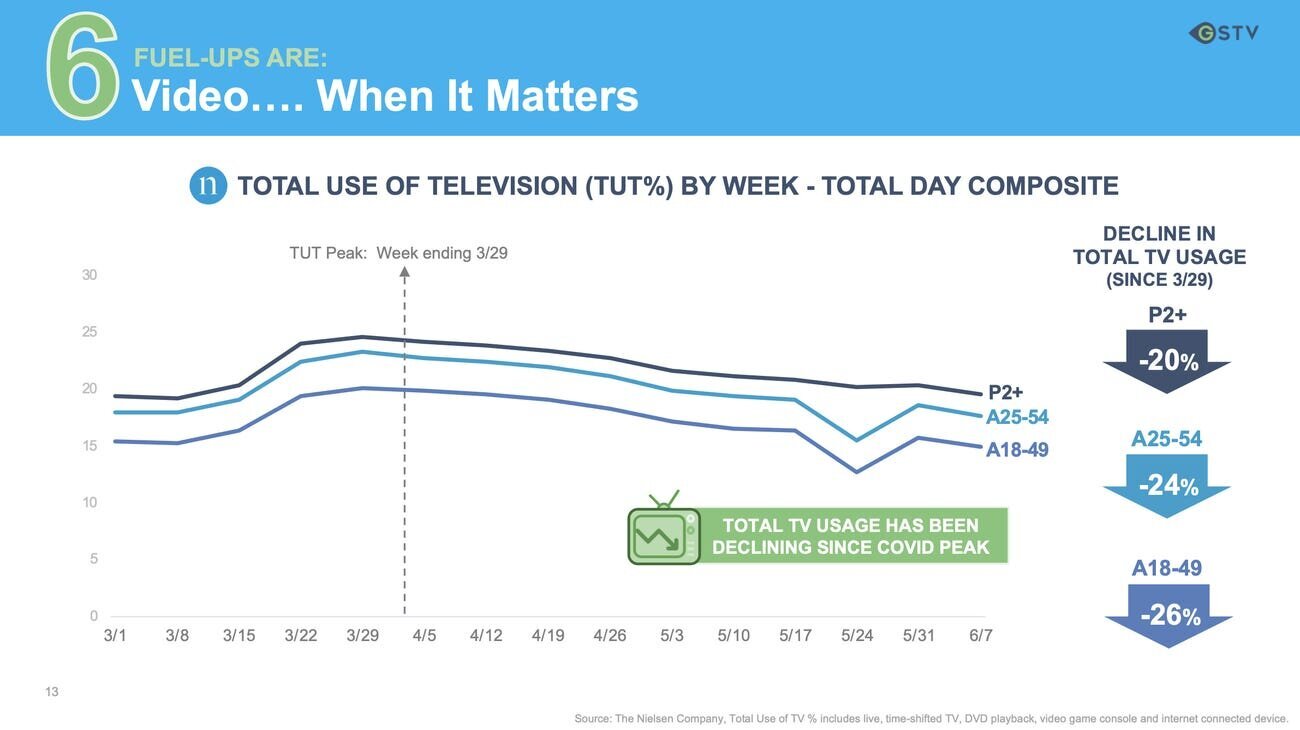

TV viewing is also down by more than 20% among key demographics since the pandemic's peak in March.

GSTV claims it can help replace the billions lost in live sports ad deals.

Gas stations were among the businesses least affected by the pandemic, according to data from Foursquare.

Martech Zone: GSTV: Target Consumers at the Pump with Location-Based Video Experiences

By: Douglass Karr | Martech Zone

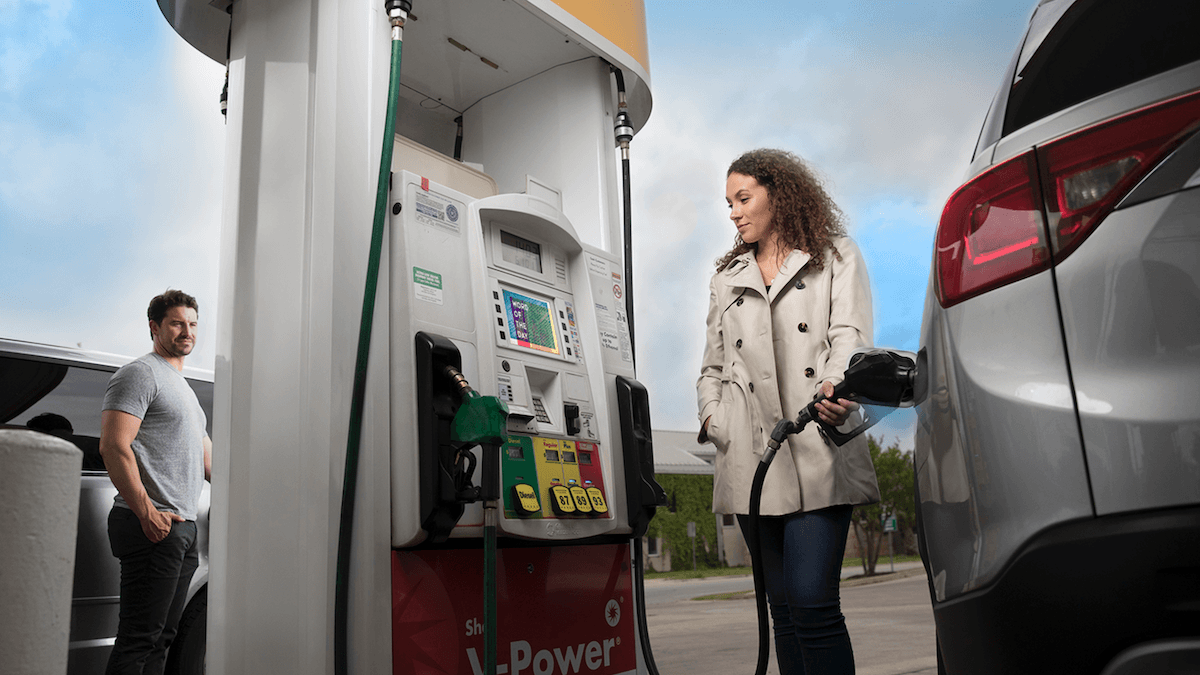

Every day, millions of Americans get in their vehicles and go. Fueling up drives commutes, commerce, and connection; and that’s when GSTV has their undivided attention.

Daily, at tens of thousands of locations, their national video network owns a unique moment that matters, when consumers are engaged, receptive, spending more today and influenced for tomorrow and beyond. In fact, GSTV reaches 1 in 3 American adults monthly, engaging viewers with full sight, sound, and motion video at an essential waypoint on their consumer journey.

GSTV Overview

Case studies of GSTV include social engagement, retail sales lift, increasing ad effectiveness, store and dealership visitation, lift in consumer spending, building viewer awareness and tune-in, and lifts in website visitation.

GSTV Short Form Video Example

Chances are that you’ve seen and responded to these short form videos that drive a call-to-action. Here’s a great example for retail establishments to get someone who is pumping gas to walk into the store and make a purchase:

GSTV Reach

GSTV engages adults with hundreds of millions of individual 1-to-1 interactions to entertain, inform, connect, and deliver a moment that moves today and matters tomorrow. Benefits of their target audiences include:

Spending – A young, active, affluent audience, who spends +1.7x more following a fuel transaction

Real People – A Nielsen audited network, with no bots, no fraud and no DVRing

Brand Safe – Premium content curated for a general audience

Engagement – Traveling, dining, listening, shopping, spending, and more while engaging at a pause point in their journey

Capabilities through GSTV’s 95 million unique visitors includes the ability to target first party audiences based on their demographic, geographic, and behavioral data.

GSTV helps marketers achieve quantifiable business results and maximize their ad spend. GSTV has delivered double-digit increases in retail visitation, millions of dollars in sales lift, and significant increases in brand metrics for some of the world’s largest advertisers.

GSTV Extends Content with Loop Media

Loop Media, a streaming media company focused exclusively on premium short-form video, announced a content partnership with GSTV to produce and share short-form music videos, top new music videos, movie trailers for new releases, and top movie trailer compilations.

This short form streaming content provides opportunities for brands and marketers to effectively target consumers outside the home.

Adweek: GSTV Understands Crisis Messaging to Guide Brands Through Covid-19

By: Doug Zanger | Adweek

Key insights:

The network of screens at gas stations and convenience stores reaches 1 in 3 American adults.

GSTV expects to play an even more vital role, as people who choose to travel this summer will likely do so by car.

As the pandemic continues, brands are determining the best way forward in terms of their messaging to consumers. Like advertising before Covid-19, people were inundated with all kinds of marketing that could simply get lost in the shuffle.

A great deal of advertising has shifted online as people hunkered down at home. Yet essential businesses remained open, including gas stations and the convenience stores attached to them. GSTV—which broadcasts advertising and content at the pump—found that messaging on the platform’s 24,000 locations became essential communication. GSTV reaches one-third of American adults each month and counts Nielsen, Comscore, IRI, Placed and others as data partners.

As quarantine spread across the country, GSTV’s partners, predictably, shifted their messaging to public service announcements from the likes of the Centers for Disease Control and Prevention, Red Cross and Feeding America. Though a pandemic isn’t necessarily in any playbooks, the platform has extensive experience in times of disaster, such as hurricanes, floods and other times when an area goes dark.

“We’ve seen a little bit of a parallel to times like that where important messages need to get out there,” said Sean McCaffrey, GSTV president and CEO.

McCaffrey estimates that in the first few weeks, pandemic-centric advertising accounted for around 90% of the platform’s content.

“We are so grateful to GSTV for their support of our critical Covid-19 messages around social distancing and joining the #StayHome, Save Lives initiative,” said Lisa Sherman, Ad Council president and CEO. “GSTV was one of our first partners to offer their support in the early days of the crisis, and their extraordinary network of gas stations and convenience stores have delivered our time-sensitive messages to over 95 million people across the country.”

“We’ve always been 3-5 minutes of someone’s day running errands,” added McCaffrey. “We realized that those errands were more important because people were stocking up, or are essential workers. At a minimum, people want something informational and, at best, something a little entertaining.”

Interspersed among the ads, for example, was content from the NFL around April’s virtual draft. At present, McCaffrey said about 30% to 40% of the content is directly about Covid-19, with other brand messaging and creative filling the rest of the inventory.

“We’re trying to make sure that it has some uplift, in addition to helping people be safe,” he said, noting the platform’s other content partners such as Cheddar, What’s Trending and Stadium.

According to McCaffrey, brands have asked for flexibility in managing the next steps, seeing very few cancellations, unlike on TV. Categories that seem to be forging ahead are QSR and more long-term businesses such as mortgages and cars, with tweaks to messaging.

“GSTV has been a valuable component of our marketing strategy for years,” said Casey Hurbis, CMO of Quicken Loans. “Whether our campaigns are focused on growing awareness of the Rocket Mortgage brand, or, in recent months, on opportunities to express our gratitude for the heroic front-line workers in the battle against Covid-19.”

Other brands are coming online, including Verizon and Live Nation, with the latter promoting a livestreamed concert series. And Dining at a Distance, a program to help encourage delivery and support of restaurants, continues to make an impact.

“We jumped at the opportunity to support our Dining at a Distance initiative on their platform,” said Pete Stein, CEO of Huge, the agency leading the program. “Because of GSTV’s vast reach, we were able to share Dining at a Distance across 43 markets, reaching a wide audience in a local way that drove action.”

Inquiries about the platform are increasing as brands figure out their playbooks. In the meantime, the conversations with brands revolve mainly around the context of messaging. According to McCaffrey, even though the scope of the pandemic is changing, ensuring that brands get the tone right remains critical.

“If you have a message that’s tone deaf right now, it’s not something that we want [on the platform],” he said.

Looking forward, with all kinds of scenarios emerging around the possible return of Covid-19 cases, McCaffrey said GSTV has learned from its experience with disasters and the pandemic and can move quickly if messaging needs to return to more information-based ads.

“We will always consider the possibility of another outbreak in all of our planning for the next 12-18 months,” he said.

In the end, though, it’s about serving brands, and McCaffrey believes that providing a sense of calm in a hectic time is crucial. The company is planning for the possibility of a busy summer, when consumers may drive more than fly if they choose to travel. Whatever the case, McCaffrey believes that providing a sense of calm in a hectic time is crucial.

“Marketers are consumers first, and everyone is getting whiplash from the data and news cycle. No single partner has all the answers or all the solutions. We know an already complicated job just became exponentially more difficult and is changing in real time. We owe our brand and agency partners the guidance on how to use our massive consumer attention in the right tone and message.”

In 2020, Content Diversification Will be Brands’ Top Challenge and Opportunity

Lack of order and predictability in how content is consumed is reaching new scale; budgets are shifting to reflect it

Sean McCaffrey, President and CEO, GSTV | Abridged version on Campaign

As CEO of a national media network, I spend the majority of my time meeting with global brands across nearly every consumer category, to better understand how they’re specifically solving marketing problems. The buzzwords may change, but core challenges often remain the same. And all involve driving business and brand growth with marketing expected to deliver as a key growth driver. What they share paints a picture of the problems they’re facing now, and the headwinds they’re planning for in 2020.

The through-line in 2019 is that the forces impacting their marketing are guided by the invisible hand of content diversification - both the cause of and solution to these problems. As consumers spread out in pursuit of their interests, the smartest people in our industry devise ways to turn that differentiation into usable data that can help brands get closer to them. The data-driven debate has raged for the past decade on targeting vs scale, reach vs personalization, and brand vs growth marketing.

In 2020, consumers ready to scroll and skip at scale, will crash headlong into other trends that create new challenges and opportunities. Below are a collection of topics and trends from my conversations with brands, each of which is grappling with a shift in the content landscape, with notes on their approach to adapting.

TV TUNE OUT & CONTENT CONSUMPTION SHIFTS

A November report from eMarketer suggests that linear budgets will drop below 30% of total spend next year, for the first time ever. The question for brands whose dollars are part of that $2.4b dollar spending gap, is: how will they spend it, if not on TV?

Behind this massive shift is the continued decline in broadcast viewership, which is perhaps the biggest driver of change impacting marketing today. While TV was at the center of the Big Bang that led to the the narrative-driven advertising universe we all emerged from, today it more closely resembles a star that’s about to implode.

Disney+, HBO Max, Apple TV+, NBC’s Peacock, Hulu, YouTube, Facebook, Twitter, Snapchat, TikTok and many others are filling the void. Baby Yoda aside, the wars being waged by all of these companies as they pursue advertiser dollars are anything but cute. And the rise of more services, subscriptions and consumer control is a boon for content bingers, but yet again a challenge for marketers to balance reach, targeting and strategy in a media plan needing to solve serious marketing challenges.

Brands have to navigate them all, which means their budgets need to be built for agility. The days of set-it-and-forget-it are long gone; brands need to know where every dollar was spent and what it did for the brand, no questions asked.

Take Hershey’s for example. Six years ago, they were convinced linear TV was the way to go, representing 97% of their budget. This year, linear is under 50%, underscoring that diversifying their media investment is key for growing their brands and reaching new customers.

Of course, TV isn’t going down without a fight. Earlier this year, Nielsen announced it will be counting “out of home” viewing – watching via mobile, in hotels, restaurants and at other people’s houses – to give a clearer picture of true audience size. As the trend away from TV isn’t slowing, this likely won’t solve the problem, but it will soften the blow.

EXTERNAL PRESSURES: SUMMER OLYMPICS & PRESIDENTIAL RACE

Layering onto the shifts in consumer content consumption, and fight for attention in 2020, are external pressures like the summer Olympics and the presidential race. They’ll live on TV (broadcast, cable and satellite alike), digital (in the form of media coverage and video) and social (breaking news and video). They will occupy mindshare, but also dominate the year in terms of available ad inventory, driving up prices and demand (per eMarketer, not enough to offset total losses for the year), again distorting the environment for brand and consumer connection.

The unprepared will be left to search for advertising platforms that can help them mitigate the lack of air time and walled garden real estate. A year ago, it would have been a safe bet that dollars not spent on linear would shift to digital, but brand safety, fraud and viewability are still challenges in digital media, and there seem to be enough new places for brands to go that digital is a bit stagnant.

For brands I’m speaking with, OTT is a pricey, confusing and still untested alternative, considered a “broadcast inventory extension” for obvious reasons, but showing promising signs of being able to validate itself from an ROI perspective. Influencers, podcasts, and OOH are all surging too, yet none of these alone are enough to give marketers the scale they need, according to the biggest brands in the country.

The takeaway for any brand trying to reach consumers: rather than fight for space among crowded inventory, refresh your media mix with new platforms that give scale and an engaged audience where you’re out of that fray.

WHAT’S COOL AGAIN: OOH & AUDIO

Podcasting fits perfectly into content diversification as it’s a key format consumers have turned to as they turn away from TV. Per IAB, marketers will have spent $479 million on podcasts by the end of 2019, a 53 percent jump from 2017. Brands believe that, in the moment of the aural environment, messages resonate when aligned with the right content.

Further, we’ve come out the other side of mobile growth to realize data and personalization and targeting still can’t always earn you attention in a sea of scrolling (300 feet or more per day now), ad blocking and so on. So the world’s oldest and largest creative canvas – OOH – is once again the shiniest new object to meet consumers on their time and dime, and bring them information, entertainment, utility and value.

To that end, OOH revenue grew 7% in Q3 to nearly $6.4 billion. This figure is a reminder of how big TV is – that amount is roughly how much linear will lose in 2020. So the OOH space continues to heat up as the largest brands, from McDonald’s, Geico, Apple, State Farm, Chevrolet, Amazon, Facebook, Anheuser-Busch, AT&T, and HBO accelerate spend and use.

Both OOH and Podcasting are seeing technological advancements that will keep them hot in 2020, namely programmatic capabilities that will extend their run as the cool kids on the block, and lead to the emergence of indirect paths to utilization.

Worth noting here: it wasn’t long ago that both audio and OOH were the least interesting media buys available. So while TV may be on the decline, it could be the hottest new platform in just a couple of years. Marketers are telling me that they continually interrogate their own assumptions about media partners, channels and choices as new innovation and efficiency does exist beyond the latest ad-tech play.

SUCCESS STARTS AND ENDS WITH ATTENTION

I wrote earlier this year that the cost of consumer attention is ROI. We’re asking consumers to apply their minds to our messages at moments where that isn’t possible. It’s the natural effect of content diversification - as we’re given more options for things to look at, we have less attention to give any particular thing.

Consider your own TV viewing habits. Are you fully engaged all the time? The old adage that we run to the kitchen during the commercial now fights with the notion that we’re on our phones, passively watching as we scroll Amazon. When we’re scrolling, we’re blind to the ads that are passing through our feeds (for the products we bought weeks ago, and returned).

Consumer behavior is a moving target, and a tricky one to ever nail down. For that reason, attention has once again captured mindshare across the market. Where can I find engaged, captive audiences, and what is being done to maintain that attention? Those attentive moments are the ones that matter for brands.

The most interesting brands I speak to all reference a similar theme: there is often innovation hiding in plain sight.

CONCLUSION

While the growing availability of content and decreasing attention spans makes 2020 out to be a chaotic year to navigate, it’s quite the opposite. There is great reward ahead for brand leaders ready to embrace the unknown and realize the strongest accelerant for marketing success is embracing the disruption by finding balance in the art and science.

Dare to be bold by challenging creativity beyond the creative. Build a media strategy that’s agile and welcomes incorporating platforms that can reach attentive consumers and deliver results at scale. Be OK with trying something new, and that might mean something so-called old that’s newly relevant again. The same goes for failing, if doing so means uncovering insights on consumer trends or discovering messaging that stood out. At GSTV, we’re bullish about the new year because these trends will challenge brands to think about what’s important to them -- audience, engagement, agility, and delivering on growth outcomes. Here’s to a great year.

Digiday: ‘An extension of our broadcast buy’: Advertisers are buying ads on gas station screens

People probably don’t pull up to the gas station pump to watch videos, let alone to sit through ads. But while they wait for their tanks to fill, there’s enough chance that they’ll check out what’s playing at the pump that advertisers including PepsiCo and Quicken Loans, and agencies such as Spark Foundry see GSTV’s gas station screens less as a billboard and more as another TV screen.

PepsiCo has begun to consider GSTV to be part of its video strategy as the company has adopted “more of a video-agnostic approach” with that strategy over the past couple years, said Kate Brady, head of media innovation and partnerships at PepsiCo. That shift has helped with analyzing the effectiveness of the marketer’s GSTV campaigns. “Because you have a captive, engaged audience [on GSTV], we see that to be stronger than what we might see on many of our digital video results and some of our outdoor as well,” said Brady, who declined to share specific results.

Spark Foundry has similarly reevaluated what it considers video in recent years. About two and a half years ago, the agency combined all video platforms, whether in-home or out-of-home, under the purview of its video team, said Shelby Saville, chief investment officer at Spark Foundry. That move enabled the agency to take a more complete view of the video landscape and find opportunities to extend the reach of TV and video campaigns “in case we’re not getting the reach we want in traditional TV or digital video,” she said. The agency uses GSTV to drive foot traffic for clients with quick-serve restaurants and retail stores, in particular.

The executives interviewed for this article declined to discuss GSTV’s ad rates, but Quicken Loans CMO Casey Hurbis described the company’s pricing as “fair and consistent.”

GSTV streams videos and ads over the internet to its screens that span more than 23,000 locations across the country. That internet-based delivery enables GSTV to aim ads at individual locations, which enables advertisers to use GSTV to supplement the reach and frequency of their TV and video campaigns. Additionally it works with companies like Nielsen to cross-reference credit card data from gas stations, including their adjoining convenience stores, with advertisers’ first-party data in order to pinpoint brands’ ads and measure their sales impact.

As audiences tune out of traditional TV and into ad-free fare like Netflix, advertisers are seeking out all opportunities to reach people with their 15-second spots. For these marketers, GSTV has emerged as one of those opportunities despite being historically categorized alongside billboards and bus stop signage as an out-of-home platform. “We’ve had a couple clients and teams recommend [GSTV] be used as a frequency extension if we feel like there’s an audience that’s being underserved in television,” said Saville.

GSTV has been looking to capitalize on ad buyers’ interest in opportunities to offset TV viewership declines by angling to compete in the annual TV-and-video upfront marketplace. This year the company has had more than two dozen meetings with advertisers to pitch for their upfront budgets, according to GSTV CEO Sean McCaffrey. In those pitches, the company has talked up the 93 million adults in the U.S. that it claims it reaches every month, as measured by Nielsen, — up from 75 million adults in 2018 — as well as the TV-like qualities of its ads that play at full screen with the sound on between videos from media companies such as Cheddar, First Media and Chive TV as well as sports leagues like the NFL and NHL.

One question that GSTV faces as it angles for advertisers’ TV and video dollars is whether people are actually watching its screens while they pump gas. And it appears that people do watch. The company performs eye-tracking studies and consumer surveys to measure viewership. In a pitch deck that GSTV has shared with advertisers and agencies this year, the company claims that 86% of people watch or listen to the screens. For PepsiCo, the question of GSTV’s viewability has not been an issue. The company has conducted brand recall and purchase intent studies for its GSTV campaigns, and the results of those studios “make us confident that it’s working,” Brady said.

While GSTV may seem to be an odd fit in the upfront consideration set, it has been able to merit consideration alongside TV networks and digital video platforms. “When we go into the upfronts, GSTV has historically been one of the partners where we make an annual upfront investment,” said Casey Hurbis, CMO of Quicken Loans. He has been buying ads on GSTV for at least seven years, dating back to when he was an automotive marketer at Fiat Chrysler Automotive and where he said GSTV was viewed as a cable network. “I’ve never really looked at [GSTV] as an out-of-home placement. I look at it as an extension of our broadcast buy,” said Hurbis.