GSTV Seeks Great Creativity for Its Video Network at Service Stations

Sean McCaffrey on the growing platform's approach

Last Halloween, service stations across the country jolted millions of consumers as they filled their tanks. On GSTV’s nationwide network of pump-based screens, video host Maria Menounos morphed into a freaky, threatening dude via deep-fake technology. The segment hyped a hair-raising digital experience from filmmaker Jason Zada exploring the dangers of rampant data collection (and updating themes from his viral "Take This Lollipop" effort a decade ago).

The stunt generated 18.4 million impressions in 11 days, illustrating GSTV's ability to reach a captive, highly diverse audience.

"It was a flash of 'What did I just see!?' It got viewers buzzing," recalls GSTV president and CEO Sean McCaffrey. "As a national video network, we want to entertain and inform our viewers, while in this case also highlighting very real concerns."

McCaffrey joined the network at its 2017 inception, driving growth by developing snackable content for folks on the go, and enticing advertisers to come along for the ride. His road to the future runs through some 25,000 current locations—double the number at launch. By year's end, another 5,000 stations should come online.

With McCaffrey at the wheel, the network, which reaches roughly one in three Americans each month, "has transformed every area of the business, from the content experience to the depth and breadth of advertisers that partner with us," he says. "We've also solidified our product offering and improved the tech platform by which it's delivered. Every change was led and informed by listening to our audience."

For example, GSTV carries food hacks from So Yummy and music news produced by Live Nation and Loop Media because "those who fuel up tend to be on their way to eat or to a drive-thru, and many consumers are also listening to music in their cars," McCaffrey says.

"Loop's short-form gaming and music content is perfectly suited for GSTV's captive platform format and audience," says Greg Drebin, Loop's marketing and content chief. Loop airs a segment each week with snippets from trending music videos and video games.

Other providers powering the network's stream include Cheddar News, Stadium, Wave.tv and What's Trending, along with GSTV's own Ignite creative studio, which develops original programs. Podcast star Menounos joined the lineup last summer, covering lifestyle, health and celebrities. Some programming runs seasonally, notably sports highlights. Regional targeting also comes into play, with the network's Octane analytics arm leveraging data from Claritas, Dstillery and the U.S. Census Bureau to craft flexible, targeted brand opportunities based on demographics and consumer behavior.

Shooting for the MoonPies.

"We don't consider ourselves parallel to other platforms out there," such as screens in taxis, trains and airlines, or Clear Channel Outdoor, where McCaffrey spent 16 years overseeing strategy, marketing and partnerships, he says. Instead, he views GTSV as a hybrid, fusing "broadcast's reach and scale with the targeting and measurement capabilities of digital, and the real-world opportunity of mobile and out-of-home media."

Because so many different types of people criss-cross our nation's roadways, the network can help brands reach commuters and travelers of varying ages, backgrounds and ethnicities "at a moment they are both paying attention to advertising, and on the path to purchase," he says. "We work with partners to message at the lower end of the funnel with calls to action directing viewers to a drive-thru or convenience stores—and at the higher end of the funnel, for low-frequency buys, like auto or financial purchases, building affinity through a routine weekly engagement."

One such low-end play took place on Super Bowl Sunday in 2020, when MoonPie and creative agency Tombras ran an 80-second commercial, reaching GSTV viewers as they picked up snacks for the game. Fittingly, part of the spot was set at a filling station.

"It got a lot of buzz because people thought it was a fun, irreverent idea—but for me, it was important because it was such a smart idea," says Tombras creative chief Jeff Benjamin. "We could have spent a gazillion dollars running a Super Bowl commercial on television, and it would have run for 30 seconds, one time during the game. Instead, we got so much more value running on those pumps."

All told, that campaign generated 5.3 million impressions in a single day.

"It cost less [than a Big Game buy], and we were able to engage with consumers over a much longer period of time," Benjamin says. "Plus, the audiences were steps from convenience stores, where MoonPies are sold. There was a dramatic sales lift on game day and for a period after that."

Doing good in Covid times.

While entertainment is key, the network's screens also broadcast critical information in times of floods, fires and natural disasters. "GSTV was a network situated on the essential front lines alongside our retail partners who never shut down and served as an essential source of fuel, food and information," McCaffrey explains.

At the height of Covid, GSTV delivered messages from the American Red Cross, the U.S. Centers fro Disease Control and Prevention and Feeding America, among others, while also thanking UPS workers and other front-liners for their service.

"GSTV has been instrumental in helping to extend the reach of our CDC PSAs in the OOH market, particularly during the past year," says Liz Johnson DeAngelis, the Ad Council's VP of growth and managed platforms. "When Covid first hit, they helped distribute life-saving messages around staying home and social distancing."

More recently, the network "stepped up to help support and amplify 'It's Up to You,' our vaccine education campaign," DeAngelis says. "They delivered relevant messages to Hispanic, Black and general market audiences in key markets using six different 15-second spots." That's a wide net—critical for driving vaccination participation en mass, Rushton says. In just a few months, GSTV's pro-bono support generated 48 million impressions.

At the same time, the service has expanded its partnership with the National Center for Missing and Exploited Children to share images of missing kids and help build a robust alert network with retail partners. "We know that recoveries can often happen at or near fueling and rest stops," McCaffrey says.

Driving into the future.

Of late, McCaffrey has shifted GSTV's own profile into higher gear. In March, for example, the brand joined with Muse by Clio to become the presenting sponsor of Tagline, a podcast that tells the stories behind legendary ad campaigns.

"One of our goals is to work more closely with creatives and creative shops," McCaffrey says. "We're a network that is poised for creative storytelling in a unique consumer context. We believe we are one of the increasingly few places you can get real reach and be in the 'right place, time and moment' … and without skipping, blocking and interruption."

Reaching "ad nerds"—passionate folks at agencies and brands on creativity's cutting edge—is essential because GSTV views itself as a robust resource, capable of real innovation. Wild ideas and bold directions—such as "Take This Lollipop 2" and MoonPie's Super Bowl spot—are welcome, if they work across the three to five minutes users typically spend filling up, McCaffrey says.

With summer fast approaching, and the U.S. emerging from the pandemic, McCaffrey's 2021 plans include a renewed push for vacationers' attention with GSTV's "Great American Road Trip" series, a wide-ranging celebration of travel and discovery, produced in-house.

"The series has integration opportunities built in for clients and opens up natural opportunities for brands and categories that contribute to a memorable road trip—travel and tourism, of course, but also QSRs, CPG, automotive, etc.," he says. "Our team is always looking for the next great creative campaign, and we want to be a partner in helping clients explore and push the boundaries on the possibilities with our network."

TV advertisers are warning they'll shift spending elsewhere if prices get too high, and streaming video and audio could be the big winners

Television ad buyers and sellers are readying themselves for a transformational TV upfront.

Ratings are down, but TV ad prices are expected to increase by double digits.

Advertisers plan to shift dollars to streaming video and audio if prices get too high.

After a year that's been compared to the Great Depression, TV advertising is expected to rebound to a 9.3% increase in 2021, GroupM forecast in March.

But the numbers mask another reality. With ratings declining, marketers are sucking money out of linear TV. Of the TV buyers who are already putting their money into connected TV, 73 percent said their budget was coming from linear TV, according to an Interactive Advertising Bureau report.

And with the cost of a CPM (cost per one thousand viewers) expected to increase by double digits at this year's upfront, TV networks' annual pitch to advertisers, some advertisers are ready to move dollars to digital video and audio.

"We can shift significant money; we are not at the mercy of ridiculous rates of change," warned one ad buyer. "Media partners are going to try to milk their traditional business for as much as they can get."

TV ratings keep falling, but prices are rising

People continue to trade pay-TV packages for non-ad supported services like Netflix, Amazon, Apple, Disney+ and HBOMax, and ad-supported streaming ones where the ad inventory is far smaller than that of traditional TV.

Bernstein's Todd Juenger reported this week that broadcast primetime viewing fell 22 percent among 18-49 year olds in the third week of April versus a year ago. Meanwhile, digital video viewing leapt 25.4 percent to 133 minutes per day, per eMarketer.

Separately, broadcast network scatter pricing, an indicator of upfront pricing to come, is running 27 percent higher than upfront rates paid last year, according to a Standard Media Index report for MediaPost.

Advertisers are left with fewer linear TV viewers, but even as they're eager to spend to capture what is being termed "COVID revenge spending," it's unclear how much they're willing to pay to reach them.

"It's transformational," said Sean McCaffrey, CEO at national video network GSTV. "Last year slayed the sacred cows of the industry: How it's done; how it's transacted; impressions, distribution, production. Never have all the advertisers and all ad agencies at the same time thought about re-arbitraging value and where they invest. They're all considering the shift into the next normal."

Traditional TV is getting too pricey for some advertisers

Some advertisers are already looking to spread their dollars elsewhere if TV ad prices get too rich.

"Linear ratings are declining, pricing is going up, and inventory is getting tighter and tighter," said Katie Haniffy, PepsiCo.'s head of media. "So I think strategically, we'll place a couple of big bets in the places we want to play and then we'll try to build a holistic media strategy across the board and be more inclusive of other channels because audiences are reachable elsewhere."

Geoff Calabrese, chief investment officer at Omnicom Media Group, North America, said: "Clients are preparing themselves for a different marketplace. It's all about ROI, and if we need to expand the aperture beyond the largest partners, we will. The biggest thing you're going to see is partners wanting less linear and more streaming because that's where consumption is going and that's where sales models have moved."

If the price to value equation gets too out of whack, one agency buyer said they'd shift dollars to audio, where players such as iHeart, Spotify and Pandora, are ready to catch the ball.

"Maybe there are different channels where we can shift significant money and find audiences so we are not at the mercy of ridiculous rates of change where the media companies have acknowledged they are going to try to milk their traditional business for as much as they can get because demand is through the roof," the buyer said.

Meanwhile, at the IAB NewFronts this week, digital video purveyors from magazine companies to TV set makers rolled out their attempts to grab linear TV dollars.

Two broadcast network owners, Fox and NBCUniversal, are playing in both sandboxes, pitching their streaming ventures. On a call with investors on Wednesday, for example, Fox chief executive Lachlan Murdoch spent a sizable portion of the time discussing just how big Tubi is. "We are deeply integrating Tubi into this year's upfront discussions," Murdoch said. "Tubi represented 275 million hours of total view time streamed in March, a monthly record for the platform. We also set a record for total view time in the third quarter, with 800 million hours streamed, up more than 50 percent year-over-year."

TV buyers will come to the Upfront with digital video numbers and more buying options fresh in their memories.

In last year's upfront, when the pandemic wreaked havoc on advertising plans, networks let buyers cancel their buys on a much shorter schedule than normal. Buy-side executives want flexibility to be the buzzword of 2021, too. Networks that typically require a month to 45 days notice for cancellations will have a hard time competing with connected device Roku, which is letting clients cancel 100% of their commitments on two days' notice.

Are network owners fueling their own demise?

Big media companies might argue their record-breaking, multi-billion dollar outlays to the NFL in March is a sign they are still investing to amass big audiences. But network TV, once the ultimate gatekeeper of premium TV, is now competing in an ever-expanding universe of streaming channels awash with the bottomless archives of the Hollywood studios.

Ad dollars that used to fund original programming on network TV are now funding their streaming initiatives, whose viewers are younger than network TVs, further degrading network TV viewing and boosting pricing.

"It's not like the media companies are investing in new content to get the ratings to return to traditional linear," said one agency TV buyer. "They have given up on that. Yet they want clients to pay these incredible rates for access to that inventory, and they're using current investments in data, tech and media to fund their future DTC streaming business."

If there's a saving grace for TV, digital video sellers have their own issues, such as a smaller available ad inventory, high prices, and a lack of standardized measurement.

"The last year just accelerated existing trends, the shift from linear, the rise of connected TV," said GSTV's McCaffrey. "Digital has been the make-good for broadcast, but now that digital has its own challenges. It feeds into the narrative that brands are truly reconsidering everything. It's unlike any moment that I've ever seen."

The CTV ad measurement conundrum that creates more questions than answers

In a complex landscape that includes streaming platforms and connected devices – all of which have their own approaches to media buying and ad measurement – it’s harder than ever for marketers to get a solid grip on how their ads are performing on CTV. So, here’s what you need to know about the current state of ad measurement in CTV, and what’s to come.

Connected TV offers countless benefits to marketers. Ad targeting is made simpler since advertisers have access to data about users’ category preferences and the shows they watch. This enables them to serve relevant ads to target audiences based on this information. And, of course, viewers have been binging streaming content, so there’s no question that the audience is there.

But in the new high-definition world of content, ad measurement hasn’t yet come into full focus. With so many players in the mix – including connected devices from makers such as Roku, Apple TV and Chromecast, and an ever-expanding pool of streaming services with their own operating systems – it’s easy to see why measurement is no easy feat.

The challenges of accurate CTV ad measurement

The challenges of ad measurement in streaming stem primarily from the fragmentation of the ecosystem. Put another way: there’s no common currency.

While Nielsen’s framework worked seamlessly within the well-oiled machine of linear TV, there are no such accepted standards of measurement in CTV. “Traditional TV audience measurement methodologies, like Nielsen’s panel-based approach for linear TV, were designed for large audiences watching a relatively small universe of content in a world in which the content on the screen was a good indicator of the ad being served,” says Eric Sherman, executive vice president of insights and analytics at GSTV, a national video network rooted in gas station television. “In a sprawling, addressable, and highly-dynamic CTV ecosystem, that approach doesn’t give advertisers the insight they need into campaign performance.”

A key issue is the lack of common identifiers across the different CTV platforms. This further impedes standardization. CTV media buyers are clamoring for a universal, cross-platform identifier to make planning and measuring CTV campaigns easier.

Still, the central problem is that most streaming services have their own proprietary methods of measurement. And on top of these approaches are countless third-party vendors offering ad verification and measurement services. As a result, it’s increasingly difficult for advertisers to gain a clear and comprehensive picture of ad performance or to track metrics such as attribution.

“For advertisers and content creators using the established advertising-based video on-demand (AVOD) social platforms such as YouTube and Facebook, the measurement challenge is more about confidence in the data and access given to third-party measurement,” says Graham Swallow, head of data and insights at digital content agency Little Dot Studios. “We don’t know what YouTube defines as a ‘view’, and we don’t have any independent verification of the view data, nor even the simple ability to look at cross-platform reach or frequency.”

For video on-demand (VOD) companies – whether they are device manufacturers like Samsung and Vizio or streaming platforms like Roku – there is a similar lack of standardization. “Data collection is often a manual process, with each platform providing different levels of granularity and richness, without agreed definitions of metrics,” Swallow says. “Advertisers and agencies want ease and confidence that campaigns will deliver and numbers to back them up. There are opportunities in this space to solve these challenges.”

But it’s not just the variability in measurement standards that complicates things. “Proprietary approaches to measurement by the ‘big four’ (Roku, Amazon, Apple, Google) certainly contribute to the challenges advertisers face in painting a holistic picture of streaming ad performance. But fragmentation exists beyond just the hardware platforms,” says Sherman. “Buyers can transact across hundreds of different apps, aggregators, and publishers, further splintering audiences and complicating measurement.”

The fragmentation of the market makes it difficult to measure with accuracy. Tal Chalozin, the chief technology officer and co-founder of adtech company Innovid, says: “It’s impossible to really understand who the viewer is who’s actually watching – and if it’s the same viewer who is watching on two different devices or two apps on the same device, versus scores on multiple households or multiple people.” Due to this lack of clarity, metrics such as reach and frequency – simple, straightforward measurements on linear – become obfuscated on CTV. As a result, marketers can’t be confident that their ad dollars aren’t going to waste.

Beyond the complete lack of common frameworks, ad measurement in CTV is challenging for more obvious reasons. Even with effective targeting, there’s no guarantee that consumers will watch an ad. They may get up to use the restroom, scroll another device or chat with their family members. Plus, if users are served ads from the same campaign across different channels, it can be nearly impossible to confidently measure multi-touch attribution – identifying what specific ads and what specific actions contribute to a given consumer behavior like converting.

Jason Fairchild, co-founder and chief exec at CTV platform tvScientific, agrees that this issue of divided consumer attention impacts marketers’ ability to measure attribution with accuracy. “We live in a world where the last click from search or social claims all of the attribution credit, but we’re seeing a different truth emerge as CTV advertising is scaling up,” he says. “Users see a CTV ad and respond via a second screen. This ‘second screen behavior’ often leads to a search, but it was not caused or inspired by the search – the search was inspired by the CTV ad.”

In search of a solution

To industry players, it’s clear that things need to change in more than one way. Many believe the solution is making CTV look more like digital advertising. “With the majority of TV viewing happening on streaming services versus linear, we don’t need to retrofit the new era of TV with a panel-based measurement model from the 1950s,” says Fairchild. “I think the new era of TV measurement will be very similar to search and social, where we can leverage sophisticated digital targeting on a one-to-one basis and measure actual outcomes instead of outcome proxies like delivery of reach and frequency against target demos.”

The sentiment is one echoed across the industry. And it’s the reason for a recently announced strategic alliance between Roku and Nielsen. Announced in March, the deal brings automatic content recognition (ACR), a real-time ad detection technology, and dynamic ad insertion (DAI), the ability to serve relevant ads to targeted audiences in real time, to streaming on Roku. The device maker says that, using Nielsen’s frameworks, ad performance and measurement will enable smarter, live buying and give marketers opportunities to monetize audiences in new ways beyond basic demographic information.

Louqman Parampath, the vice-president of advertising product management at Roku, explains that this new partnership builds upon a long history of the two working together to improve ad measurement. “Very early on, we integrated with Nielsen for what is known as dollar measurement, which equates to digital ad ratings. This is to say that for every campaign that you buy from Roku, we can tell you the age and gender bucket in which audiences who got exposed to that campaign fell.”

Roku continued to work with Nielsen to replicate Nielsen’s gross rating points measurement on CTV. Amazon and Hulu quickly followed suit, adopting a similar approach. In order to maintain a competitive edge, Roku felt it had to go further. “There are other kinds of questions that need to play out here, such as incremental reach,” says Parampath. ”If you buy across multiple platforms, how can you actually duplicate between users who saw on Hulu and also on Roku and also on Amazon Fire and so on? That is where a more broad currency is possible.”

This currency could come in the form of a unified identifier, which would enable marketers to more seamlessly share data and work across different platforms within the ecosystem.

Innovid’s Chalozin, like Parampath, sees a growing demand for a universal identifier in CTV. However, unlike some who says the ‘big four’ will continue to duke it out, Chalozin believes that it could be a real possibility. “[The industry] will create a unified identifier that will allow us [greater access to user data],” he says. He claims that the establishment of a universal identifier will reduce the fragmentation of the ecosystem and enable marketers to better calculate the value of impressions. “It’s in the best interests of almost everyone in the industry.”

Chalozin readily admits that any viable universal ID solution for CTV will need to be extremely privacy-centric. Today, 84% of Americans feel they have little to no control over the data that companies or the government collects about them, according to a Pew Research study. Combine this distrust with the aggressive shifts toward increased data privacy in the tech and legislative arenas, and it’s obvious that any CTV solution will need to stay the same course.

Little Dot Studios’ Swallow agrees that privacy needs to remain top-of-mind. However, unlike many other industry players, he says that giving marketers access to more granular and more accurate data is not necessarily an inherent good or a problem that even needs solving. “Yes, an entire industry has developed off the back of what has been termed ‘surveillance capitalism’, but that doesn’t mean we must be on an inexorable path to more granularity. Globally regulators are putting the brakes on this through the likes of GDPR and CCPA.”

Even so, Swallow says there is need for standardization. “For basic and anonymous measurement, there needs to be an independent standard with an agreed methodology. It happened at the birth of advertising on the web, where first-party ad serving gradually disappeared and was replaced by audited measurement and ad-serving tools. CTV and streaming need the same to give confidence to the market on the reliability and veracity of numbers.”

For many marketers, accuracy and granularity will remain top priorities. Chief among their concerns remains multi-touch attribution – and, more generally, simply understanding where consumers’ eyes are and when. Solving these challenges will require that key players develop more effective cross-media measurement capabilities.

According to Kimberly Gilberti, the senior vice-president of product management at Nielsen, the marketing research firm is working to ensure that “computation is being done in a way that is truly comparable” across channels. “For example, television today is measured on the average minute basis, whereas digital is measured sub-minute,” she says. “So even though you can put TV data and digital data together, their underlying data collection and their underlying calculations are actually very different. They are being put together in ways that are not truly comparable. And that’s really our mission with Nielsen One: to put these numbers together in a way that they are as ‘apples to apples’ as we can make them.”

Parampath says that this is one of the key focus areas of the Roku-Nielsen deal. “We’re working to measure reach across multiple streams – it could be linear, it could be connected TV, it could be a desktop and it could be mobile. As a user, you could get exposed to the same Pepsi campaign across all those channels on your mobile app, on your computer, when you watch traditional TV through cable or a set-top box, or when you’re watching connected TV. But as it stands, you don’t actually get credit for reaching the same person across those different channels.

“You want to be able to actually say that you got incrementally new users on these channels that you did not get on some other channels.” He says this is the central objective of cross-media measurement.

Ultimately, CTV needs to see unification of some sort. Without some agreed-upon frameworks or standardized currency, the ecosystem will continue to splinter, making ad measurement ever more uncertain. Across the industry, initiatives that seek to standardize data-sharing with qualified measurement partners are under way. And outside of one-to-one partnerships such as the Roku-Nielsen deal, major industry groups such as the Association of National Advertisers (ANA) and the Video Advertising Bureau (VAB) are working to enable cross-platform measurement, which could give marketers greater, more accurate visibility into metrics like reach and frequency across channels.

But how we shift the paradigm is a bigger question. Advertisers are sure to benefit from greater cooperation and shared methodologies – it’s critical that the right economic incentives are in place to help stimulate this unification.

As Americans leave major cities, will outdoor ads follow?

By Kenneth Hein, The Drum

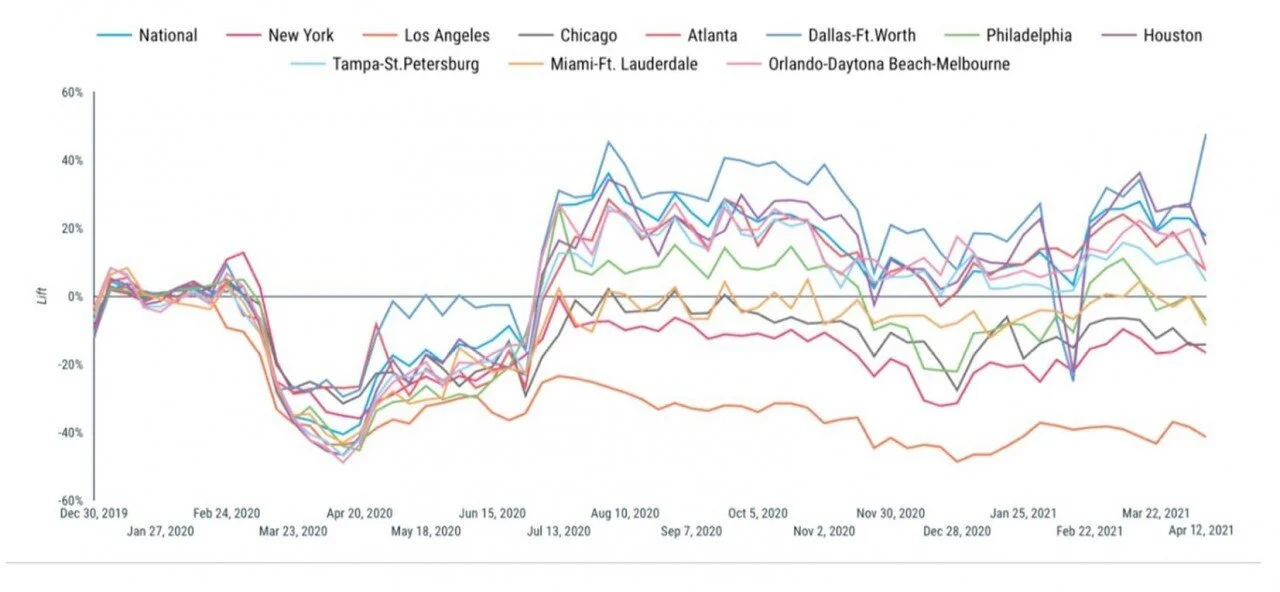

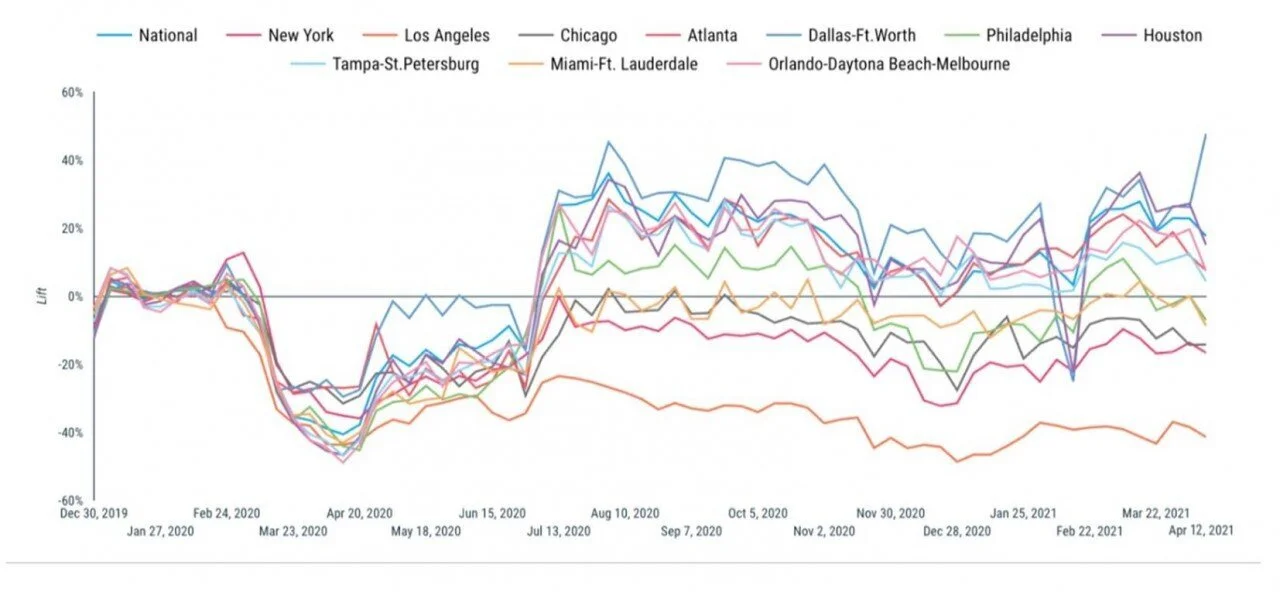

Buying out-of-home ads used to be so simple. Buy the top-10 markets and you were covered. Now, as a significant part of the US population has scattered across the country like dandelion seeds in the wind, marketers must be more thoughtful about their approach. While media buyers say brands may be slow to make the shift to buying secondary markets, the much-anticipated rise of digital out-of-home just might prove rewarding for early adopters who are following the trend.

Every other license plate in Florida is from New York, remarked a media buyer recently. This observation is part of an undeniable trend: many US consumers have migrated to secondary cities. Many may not return.

This adds a new and significant level of consideration to any marketer looking to make an out-of-home (OOH) buy as the US continues to open up. While purchasing OOH ads in the top-10 markets (like New York, Chicago, Los Angeles and a handful of other key metro areas) used to be the only box a marketer needed to check, things have changed – even if clients haven’t recognized it yet.

Today, cities like Austin, Santa Barbara, Nashville, Indianapolis and Denver must be considered, per Ubimo, a Quotient Brand. Each of these cities saw the largest increase in movement, around 340,000+ OOH properties nationwide for the week ended April 4 compared to pre-Covid.

Other cities that saw increased movement include Charleston, South Carolina, Boise, Idaho, Columbus, Ohio and Cheyenne, Wyoming – all of which are also experiencing a population influx due to relocations.

And then there’s Florida. The Sunshine State’s real estate market has been described as a circus. Paul Ryan, the former Speaker of House, says there is going to be a ‘big migration’ from New York to Florida and Texas thanks to lower taxes outside the Big Apple. Jacksonville, Florida, also saw great gains, according to Ubimo data. Gas Station TV (GSTV), which offers ads at the pump, ranked Jacksonville as the third-largest gainer in transaction volume.

The most popular spot per GSTV: Bozeman, Montana, where apparently the locals can’t find a place to live anymore because of all the Californians moving in. Bangor, Maine stole the second-place spot.

Suffice to say, many people aren’t just in the top-10 market demographics anymore. (Further proof of this fact in the Ubimo chart below.) So, what are marketers and media buyers going to do now that OOH ad spend is coming back?

An inflection point for outdoor advertising

There is no shortage of bullish research indicating that OOH ad spend will rebound. Group M, for example, predicts outdoor will grow 22.4% this year, 19.7% in 2022 and see single-digit growth in 2023.

When Angela Zepeda, chief marketer at Hyundai Motor America, worked out her launch plans for the new Tucson, OOH found its way back into the marketing mix. “Car buying is up. People are antsy and want to get out ... we are dipping our toe back into some of these OOH channels and formats where we couldn’t spend in last year. Now we’ve got these important launches to do, and we just need to be everywhere.”

Zepeda stuck with the major metros with a key focus on Dallas, Houston and San Antonio, Texas – all of which are big markets for Hyundai.

The return to OOH spending, in any market, is good news for a category that was crushed by lockdown. “Advertisers are gearing up coming out of a relatively soft Q1. I think it’s going to be a big Q2,” says Norm Chait, group director of OOH sales for Quotient, which owns Ubimo. “We are seeing re-emergence in larger markets and movement in lots of secondary cities.”

But given the migration at hand, will marketers’ media plans begin to reflect the new realities? Media buyers say it’s possible, but it won’t happen quickly. Martin Porter, head of OOH at Dentsu, says, “It depends on client and vertical. For automotive there could be bigger changes. If you move out of cities, you’re more likely to buy a car.”

Still, there are questions about the current patterns and whether the dispersion of urban dwellers is permanent, says Porter. “Once is a blip, twice is a coincidence and three times is a trend. We are in a blip or a coincidence moment, so clients are not shifting big chunks of New York or Los Angeles dollars to secondary markets yet. It will be an inflection point this summer. Will migration paths change?”

Digital OOH gains ground

While marketers may still be sold on major markets, at least for the time being, they are also becoming more receptive to digital out-of-home ads (DOOH). Digital signage options at gas stations, supermarkets, electric vehicle charging stations, malls and commuter hubs had been gaining steam until everyone was stuck on their sofas for more than a year. The allure is simple: marketers can swap out creative based on location, the weather or any of a number of other different factors. They can also measure, test and learn.

Hyundai’s Zepeda says: "Digital boards and programmatic buying just allows for a lot more flexibility. It allows us to change messages more rapidly or tailor those messages to that particular market. Anything you can do to be more relevant that speaks to a customer and their mindset or their voice, the better off you are. It feels like your brand understands them.”

It also allows marketers to reach secondary cities more easily. “There is more flexibility to be reactive, to optimize and be efficient,” says Helen Miall, chief marketer at Viooh, global programmatic digital out-of-home marketplace. “You have the ability to change as audiences move around. You’re no longer fixed to a specific location and you can use the data to make decisions as the audiences are changing.”

Barry Frey, chief executive of the DPAA, the global digital out-of-home trade and marketing association, says being able to ‘follow the audience’ is essential because of two key factors. “The trend is people want to be outside. You can’t hold people back. That trend is our friend. Also, we aren’t impacted by the disappearance of the cookie. We have our own good data. For us, if there’s no cookie, no problem.”

The dawn of the national outdoor ad buy

Marketers will always be drawn to the big, shiny vanity play buys like Times Square and Sunset Boulevard, but as DOOH advances, so does the opportunity to be much more pervasive. In fact, making national buys, which had previously been difficult, is now likely to accelerate.

Over the past couple of years, there has been a ‘connecting of the pipes’ that allows DOOH buyers to offer a national footprint. “You will see an increased share in other markets as we start pushing forward with more of a national offering,” says Michael Lieberman, US chief executive at Kinetic Worldwide. For marketers looking to broaden their reach, it’s less about adding cities and more about “thinking about what we can do on a networked basis. That’s the massive change we need to undergo as an industry – getting people to look outside of top-10, -15 or even -20 markets and thinking nationally”.

Keith Kaplan, global chief executive at Kinetic Worldwide, adds that the buying nationally also gives brands the chance to be always on. “You can always be there when they are ready to buy. You can be in front of them for the first mile and the last mile. It’s going to sound ridiculous, but this is a completely different shift in what OOH can be used for.”

Indeed, there is a lot to be optimistic about, says Dentsu’s Porter. “We are definitely seeing clients not just coming back and saying, ‘I will buy what I bought before.’ They are fully aware that people are moving around in different ways. Programmatic helps marketers target and optimize so much easier. This an inflection point in that channel ... OOH is on an upward trajectory.”

GSTV and WAVE.tv Launch Partnership To Bring Unique Sports Content To National Video Network

With New Partnership Across GSTV Network, Popular Sports Media Company Expands Audience Reach And Distribution Outside Of Owned Platforms For First Time

DETROIT (January 11, 2021) – GSTV, the national video network entertaining targeted audiences at scale across tens of thousands of fuel retailers, today announced a new content partnership with WAVE.tv, the sports media company for today’s fan that reaches over 200 million viewers and receives 3.9 billion views monthly across its portfolio of media brands.

The partnership will include the distribution of unique and non-traditional sports highlights and user-generated content from six of WAVE.tv’s most popular media brands; “Benchmob”, “Buckets”, “Rage Quit”, “FTBL”, “Haymakers”, and “Jukes”. WAVE.tv will provide GSTV with dedicated content segments to air across the national video network’s 25,000 stations. With WAVE.tv’s Rage Quit, e-sports content will appear regularly on GSTV for the first time. The partnership also opens up new opportunities for GSTV and WAVE.tv to work with brands looking to connect with a Gen Z and Millennial audience through sponsored content partnerships.

“While our programming can be discovered across the core and emerging digital platforms where today's modern sports fans spend the most time, we are constantly looking for ways to grow the awareness of the WAVE.tv brand outside of social and digital,” said Brian Verne, Co-Founder and CEO, WAVE.tv. “This is the first time WAVE.tv content will be visible to a wide audience outside of our platforms. We are thrilled to be partnering with GSTV, who is the perfect fit for our short-form sports content, and cannot wait to highlight a variety of sports fandoms with their national network.”

“WAVE.tv has mastered entertaining its viewers with captivating short form content, which is perfect for GSTV viewers who give us a few of their undivided moments of their attention while on the go,” said Sean McCaffrey, President & CEO, GSTV. “We know our audience responds enthusiastically to sports, e-sports and UGC, and we’re delighted to share WAVE.tv’s content with them as well as provide new sponsorship opportunities to advertisers looking to reach a Gen Z audience that natively loves and regularly consumes non-traditional sports content.”

WAVE.tv joins GSTV’s growing line-up of premiere content partners, including Cheddar, Live Nation, Better Together With Maria Menounos, La Liga, Loop Media, First Media (So Yummy, Blossom), What’s Trending, CNET, Stadium, NFL and MLB, among others. The GSTV network reaches 92 million unique viewers a month.

WAVE.tv’s content segments can be seen on GSTV screens starting Monday, January 11. For more information about GSTV, visit gstv.com. For more information about WAVE.tv, visit wave.tv.

About GSTV

GSTV is a data-driven, national video network delivering targeted audiences at scale across tens of thousands of fuel retailers. Reaching 1 in 3 American adults monthly, GSTV engages viewers with full sight, sound, and motion video at an essential waypoint on their consumer journey. Analysis of billions of consumer purchases demonstrates that GSTV viewers spend significantly more across retailers, services, consumer goods and other sectors, following a fuel transaction. While offering consumers entertaining and informative content, GSTV drives immediate action and creates lasting brand impressions, delivering measurable results for the world’s largest advertisers. Visit gstv.com for more information and follow us on Facebook, Instagram, LinkedIn and Twitter.

About WAVE.tv

WAVE.tv is a sports media company for today's fan. Through a portfolio of media brands, covering a wide array of fandoms and genres, WAVE.tv entertains modern day sports fans with the programming they love, produced for the digital platforms where they spend the most time.

Their programming can be discovered across Snapchat, Instagram, TikTok, Facebook, YouTube and other core and emerging platforms. Each month, WAVE.tv's entire portfolio reaches 65 million followers and subscribers (largely Gen-Z and Millennials) with a unique reach of 200 million and generating over 3.9 billion video views.

Adweek: Deepfakes At The Gas Pump Scares Up Data Privacy Awareness

The video is part of a follow-up campaign to viral 2011 stunt 'Take This Lollipop'

By Patrick Kulp | Adweek

GSTV host Maria Menounos' face is replaced with deepfake technology. Take This Lollipop

Tens of millions of Americans filling their gas tanks this week may be in for a fright at the pump this season. No, it’s not about gas prices. Rather, it’s what is expected to happen from viewing a creepy campaign about privacy issues being shown on screens at the 24,000 Gas Station TV (GSTV) locations across the country.

The scene shows the friendly face of the TV anchor at the pump transforming into the villainous visage of a man with a sinisterly voiced warning about digital data collection.

The stunt, which involved using deepfake technology to replace the face of GSTV host Maria Menounos, is part of a new online privacy campaign that also includes a hair-raising Zoom video experience putting viewers in the center of a horror movie-like plot via their webcam.

The entire project is a belated follow-up to a 2011 viral stunt called “Take This Lollipop,” a Facebook app that captivated a more innocent generation of social media user with videos of the same ominous character reciting data about each viewer collected through Facebook’s data-sharing practices.

Creators Jason Zada, a film director, and Jason Nickel, a developer, said they hoped to reprise the success of that effort and the awareness it brought to Facebook’s data policies, but were waiting for the right cause.

“We took our time only because it really felt like we needed to find the right idea with the right piece of technology at the right time,” Zada said.

“It just so happened that a pandemic made that possible with this massive shift in technology and social communication–everybody started using Zoom,” he continued. “So the question was, ‘How can we use this current time in society in technology to our advantage and take something that we all rely upon, and and sort of twist it and turn it around a bit?'”

The result is an approximately 4-minute long Zoom video experience that detects your face and places the viewer in a Zoom call with three actors, two of whom—spoilers ahead—are spirited away by some unknown entity in suspenseful fashion before an augmented reality figure appears in the background of the viewer’s own room. The remaining participant then reveals herself to be the campaign’s trademark villain.

Zada and Nickel said the original goal had been to deepfake each viewer in real-time, but they couldn’t pull off the the technology in time for the launch. Instead, they decided to incorporate the deepfake element into a deal with GSTV and Menounos to hijack her regular segment with an ominous message.

“The general idea was that Halloween has been cancelled for the most part for a lot of people. Even brands have been shifting away from doing anything Halloween-related this year. And it seemed like the perfect opportunity,” Zada said.

“But you mix that with an election year in which there are these deep fakes that exist, there is AI, there is the hacking of the election, there’s the hacking of just general politics,” he added. “It was kind of interesting to look at how we could use deepfake in a more consumer-friendly way and show people that like, ‘I could access you–not your data anymore—but I could access you, I could recreate you, I could become you.'”

A recent survey of researchers ranked deepfakes as the number-one cyber-criminal threat posed by AI. Its nefarious potential extends beyond the creation of fake news footage of public figures–an oft-discussed threat that has yet to materialize in any significant way beyond YouTube gags, per deepfake tracking platform Sensity. Other areas of concern include identity theft, video call scam extortion and its most prevalent use as of a source of non-consensual pornography.

Despite those fears, advertisers have been latching onto the tech as a way to circumvent production constraints brought on by the pandemic or spread political messages.

Meanwhile, Facebook’s Cambridge Analytica scandal has made the issue tackled by the first “Take This Lollipop” campaign a critical national political issue that played a role in the 2016 election. Could they end up being as prescient this time around?

“We’ve always been a fan of just exploring future business models around content, entertainment and technology that I think we’re going to rely upon it more and more,” Zada said. “It’s a great time to be a storyteller, in terms of being able to use technology to power and enable original entertainment that breaks new ground.”

AdAge: 'Take This Lollipop' Returns To Teach A Creepy Lesson About Deepfakes

Jason Zada's viral Facebook app gets a follow-up featuring new tech scares

By I-Hsien Sherwood | AdAge

In 2011, a creepy Facebook app called Take This Lollipop went viral. It used private data captured by the platform to send viewers on a customized horror adventure, stalked by a tech-savvy villain who pinpointed the locations of their actual houses.

Now, nine years later, creator Jason Zada is back with a sequel that taps into the danger of a new type of digital technology: deepfakes. While advertisers and satirists have used the tech to fake words from world leaders, it isn’t only celebrities who can end up in seemingly compromising positions or appear to say things they didn’t. Consumer-level apps have been banned for faking nudes of women and underage girls.

In “Take This Lollipop 2,” Bill Oberst Jr. returns as the stalker, only this time he steals viewers' faces, showing how far the tech has come from its early days, when algorithms needed hours of footage of a person to emulate their features. "Take This Lollipop" is now a dedicated site that uses webcam footage to put viewers in the film, which looks like a video chat service, complete with an AI-powered interactive chat window. One-by-one, the other viewers meet a terrible fate

Zada directed the interactive short, which was built by Imposium and enlisted the skills of deepfake artist birbfakes. Promos feature Maria Menunous of GSTV.

Morning Consult: La Liga Primes the Pump for 2020-21 Season With GSTV Content Partnership

Highlights from the Spanish soccer league will play on screens at gas stations across the U.S.

By: Alex Silverman | Morning Consult

Since officially launching its North American marketing venture with Relevent Sports in 2018, Spanish soccer outfit La Liga has leaned on its in-house content studio to churn out video for fans to view on platforms like Twitter, Instagram and TikTok. Its newest distribution initiative, just ahead of the Sept. 12 start of its 2020-21 season, takes the global soccer property from the screens in fans’ pockets to the ones they find at the gas pump.

La Liga is the latest sports property to sign on as a content partner for GSTV, a nationwide video network with screens on fuel dispensers at tens of thousands of filling stations across the country that play both video and audio. The company says it reaches 1 in 3 U.S. adults each month when they stop to fuel up their vehicle. Sean McCaffrey, president and chief executive of GSTV, said the average fuel-up takes three to five minutes, meaning drivers who fill up regularly are exposed to GSTV for 15 to 20 minutes a month.

“With all the distractions that you have when consuming content in different parts of the day, this specifically is one that you get almost undivided attention,” La Liga North America President and CEO Boris Gartner said of the gas pump displays.

According to research shared exclusively with Morning Consult, GSTV’s viewers are 28 percent more likely than the average American to visit sports websites or use sports apps, and are 25 percent more likely to listen to sports on the radio. They are also 15 percent more likely to watch FIFA World Cup Soccer and 21 percent more likely to watch MLS.

Despite the proliferation of ride-share apps and the availability of public transportation in urban areas, most Americans still find themselves at the fuel pump on a fairly regular basis. According to a 2018 Gallup poll, 64 percent of U.S. adults drive a car every day and 83 percent do so most days.

Each week during the soccer season, La Liga will create original short-form highlight reels featuring the top goals, saves and dribbles from the previous week, which GSTV will incorporate into its daily 3.5-minute programming loops that include about a 50/50 split of content and commercial messaging. La Liga will initially only deliver English-language content for GSTV, but Gartner said it could potentially shift to creating Spanish-language segments to run on GSTV in specific markets.

Terms of the agreement between La Liga and GSTV were not disclosed, but the network said it compensates its content partners under a digital ad revenue sharing model. Gartner confirmed the league is receiving incremental revenue from the deal, but made clear that exposure in key markets like Los Angeles, Chicago, Miami, Dallas and Houston is the primary motivation behind the deal.

GSTV screens are located at 24,000 fuel retail locations, including 7-Eleven, Arco, BP, Circle K, Chevron, Exxon-Mobil, Gulf, KwikTrip, Marathon, Phillips 66, Speedway and Sunoco, in the 48 states where drivers are allowed to pump their own gas (New Jersey and Oregon are full-service only by law).

La Liga is GSTV’s fourth sports content partner, joining NFL Network, MLB Network and digital multicast network Stadium, and the first to offer soccer content on the platform. McCaffrey said the company has about two dozen programming partners at a time spanning a range of subject areas. The current lineup includes business content from Cheddar, music clips from Live Nation and recipe tips from Chowhound.

For La Liga, reaching fans through non-traditional channels is particularly important given the league’s relative lack of distribution on linear television. The league has a media rights agreement with beIN Sports through 2024 for the United States and Canada, which a source said pays slightly more per year than the $166 million NBC Sports pays annually for the English Premier League’s U.S. rights, but beIN has struggled to achieve wide distribution on cable and satellite television.

McCaffrey acknowledged GSTV viewership dropped roughly 20 percent earlier this year as people locked down due to the coronavirus pandemic. Now, with many stay-at-home restrictions lifted and drivers returning to the road, he said GSTV is now reaching more people than before COVID-19.